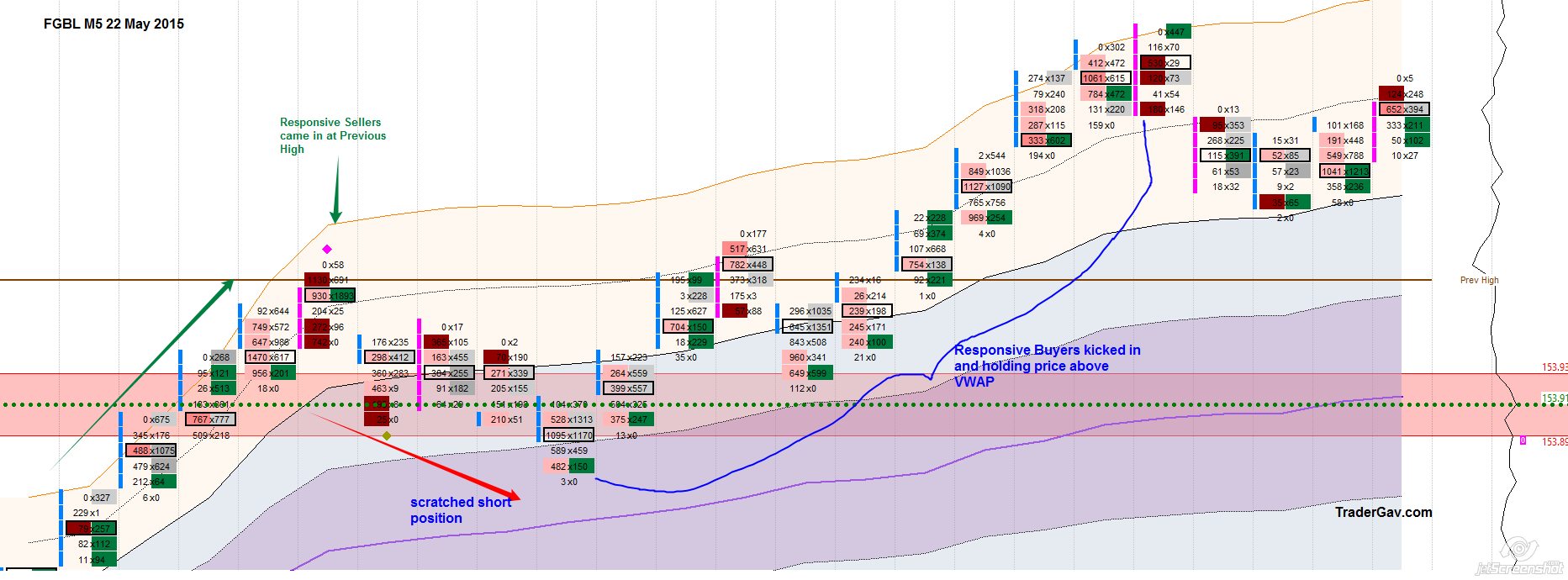

22 May 2015 FGBL Footprint chart

Trading Journal

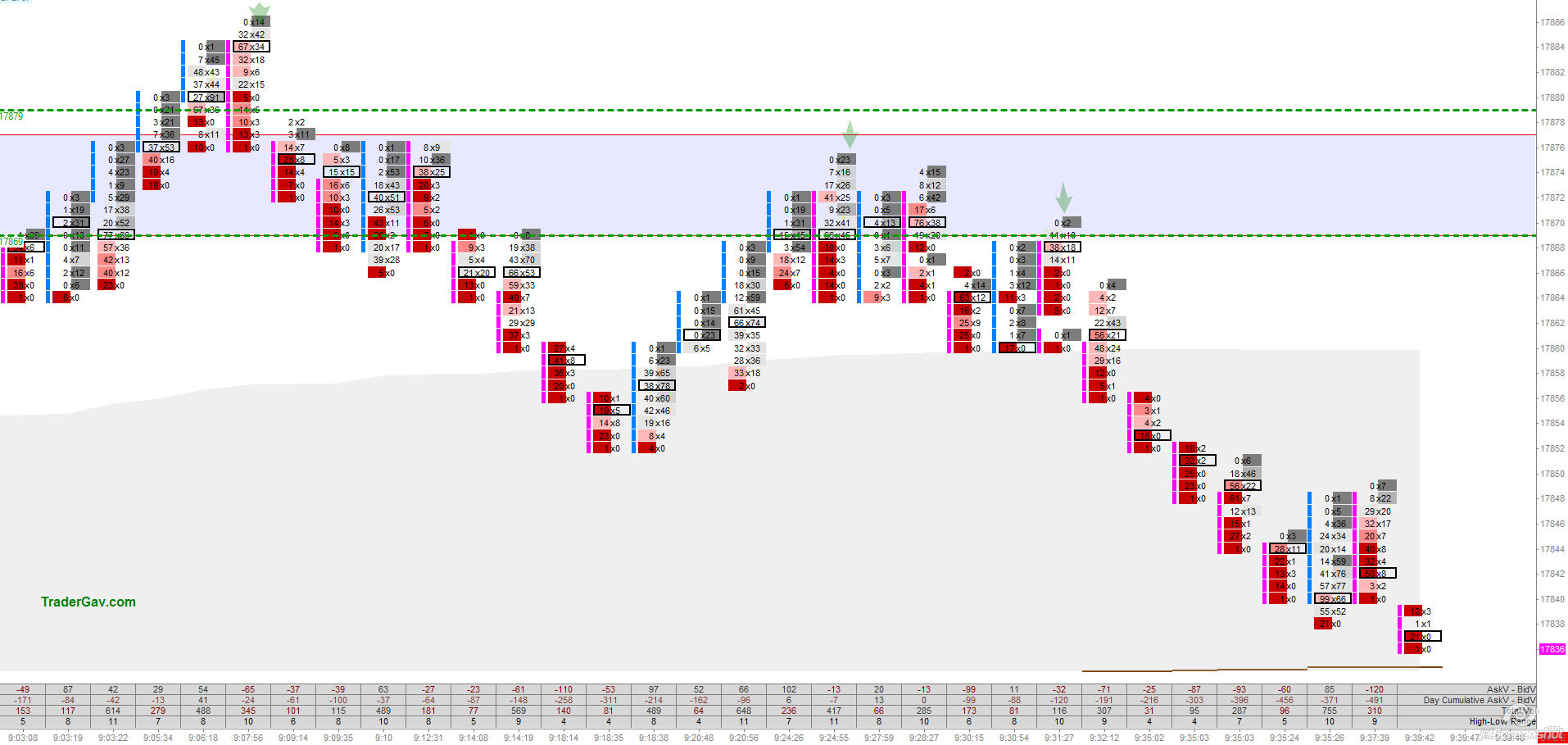

09 April 2015 YM Entry chart

YM 3 intraday swing entries during morning session.

Day Review: YM 14 Jan 2015

Major movement of the day was during pre-open when economic releases were scheduled. 3 setups were observed during RTH. Looking at at hourly chart, I was targeting the major swing low 17177 to be visited. The first setup was when YM revisiting VWAP, and at the same time it was the first test of supply […]

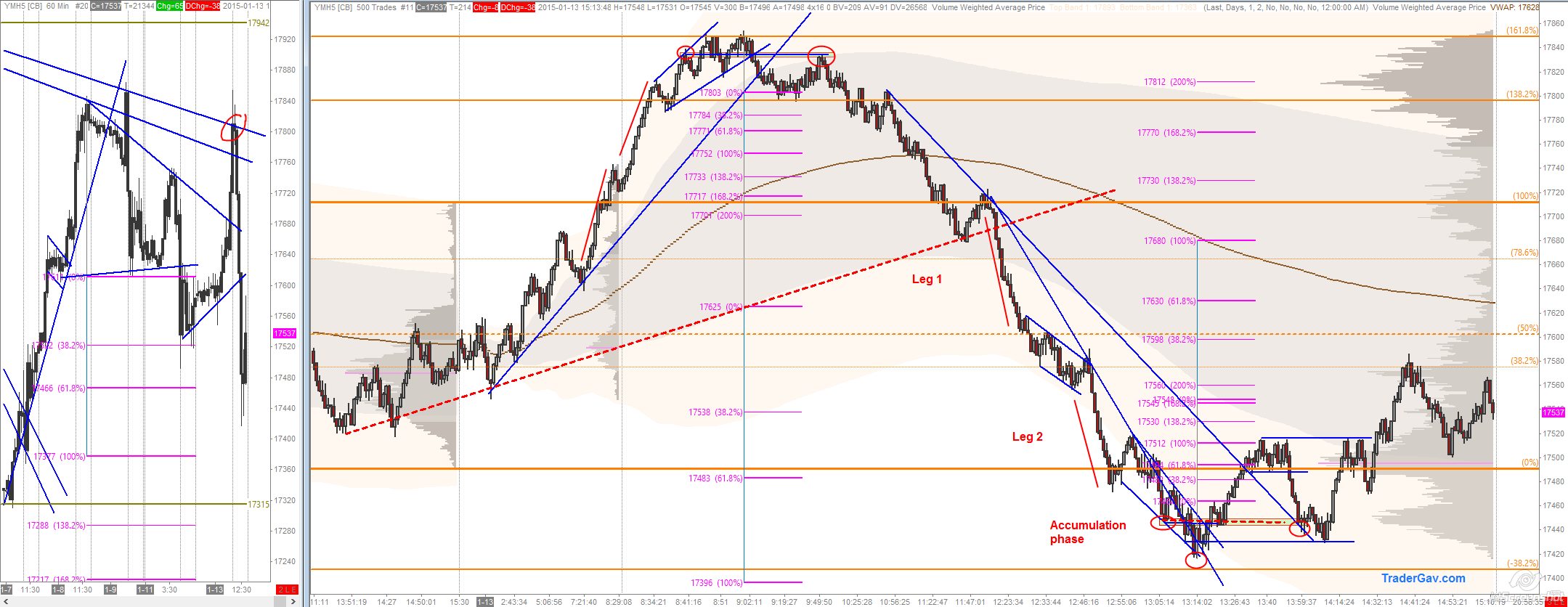

Day Review: YM 13 Jan 2015

Two reversal setups were observed during Tuesday session. First trade was the mean reversion setup when the trend line break and over-and-under (or Quasidmodo) pattern was formed at the developing value high which was around 17820. Target was to see YM auctioning back to VWAP, around 17753. Second trade setup was around 1330 chicago time, […]

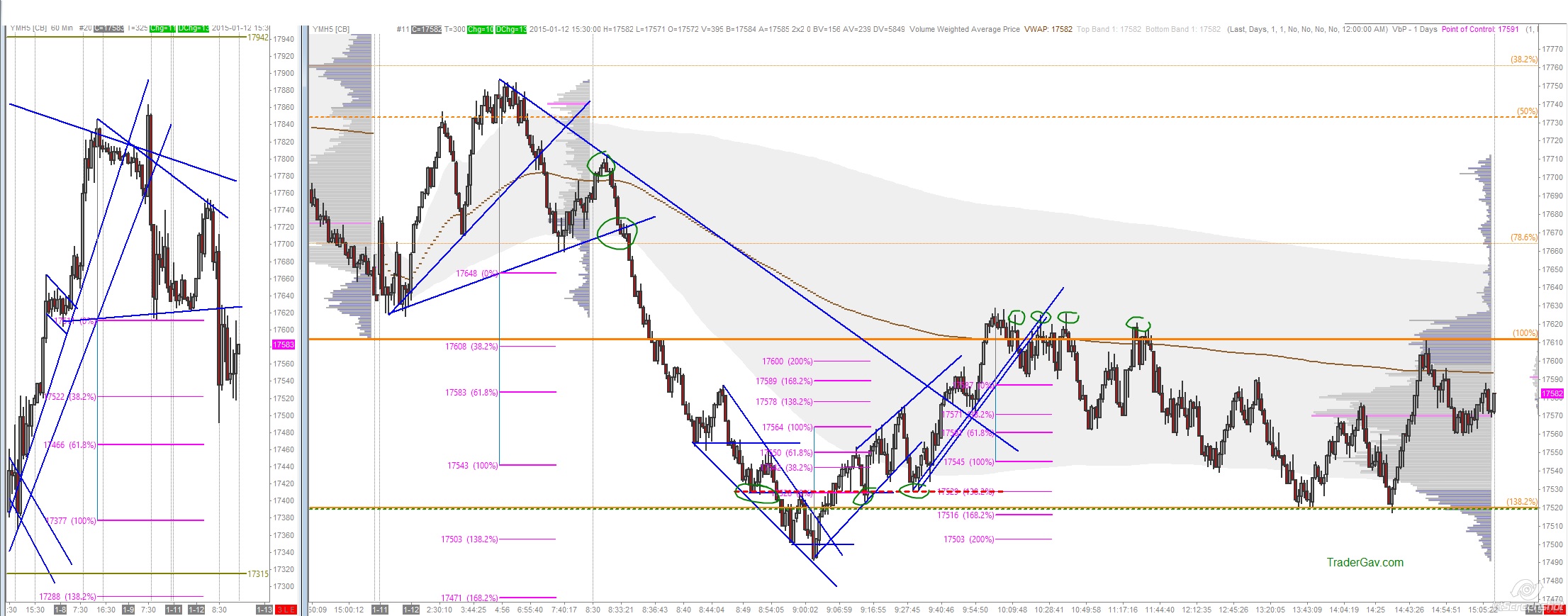

Day Review: YM 12 Jan 2015

3 types of trade setups were found during Monday session: 1. Opening Drive 2. Mean reversion 3. Triple Top reversal During Pre RTH, YM broke the short term uptrend line and traded at the developing value area low. The rejection of VWAP at the open, gave me a more confidence about the potential selling. First […]

Day Review: YM 09 Jan 2015

Here is the day review after I replayed the market. No live trade was taken today, this post is meant to review price action of the past session.