Here are quick EOD view of the 4 instruments I am trading. Key summary: Bund (FGBL) did a one-tick test of 09 May 2016 low yesterday. Stoxx (FESX) inside day breakout failure Emini S&P futures (ES) failed test of Monday VPOC, and seeking lower balance All charts prepared using Sierra Chart.

Trading Journal

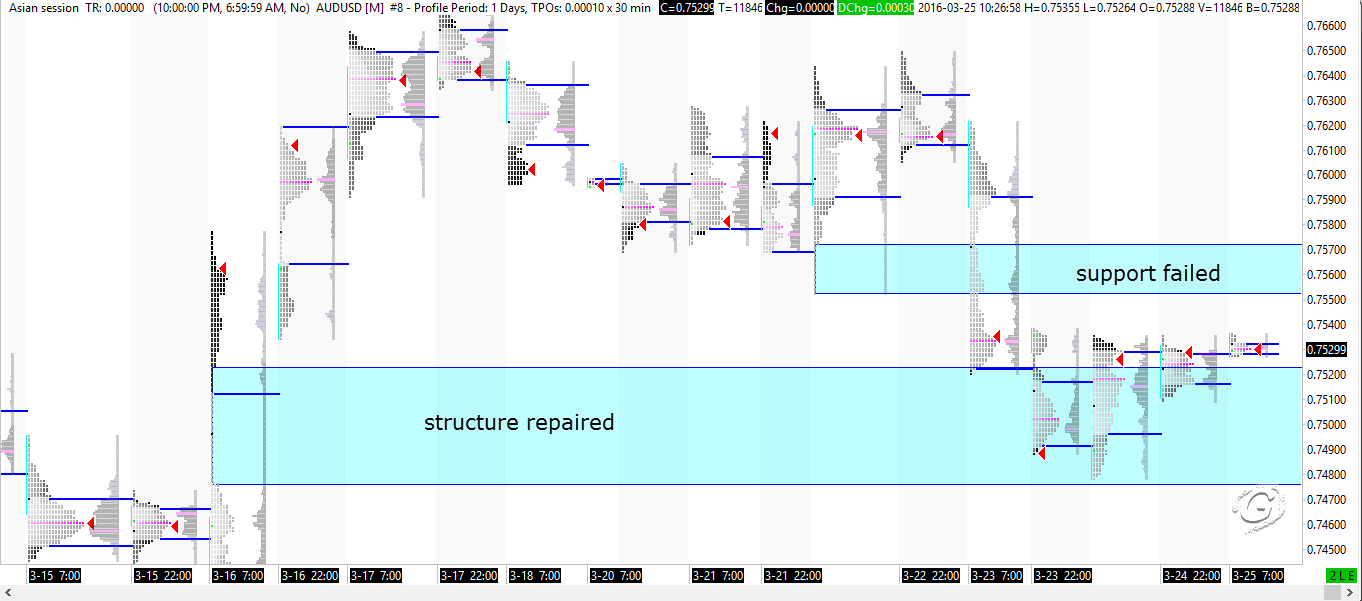

AUDUSD chart update 23 March 2016

Refer to previous post for levels and structure identified. 7476-7528 single prints was repaired. Charts prepared using Sierra Chart.

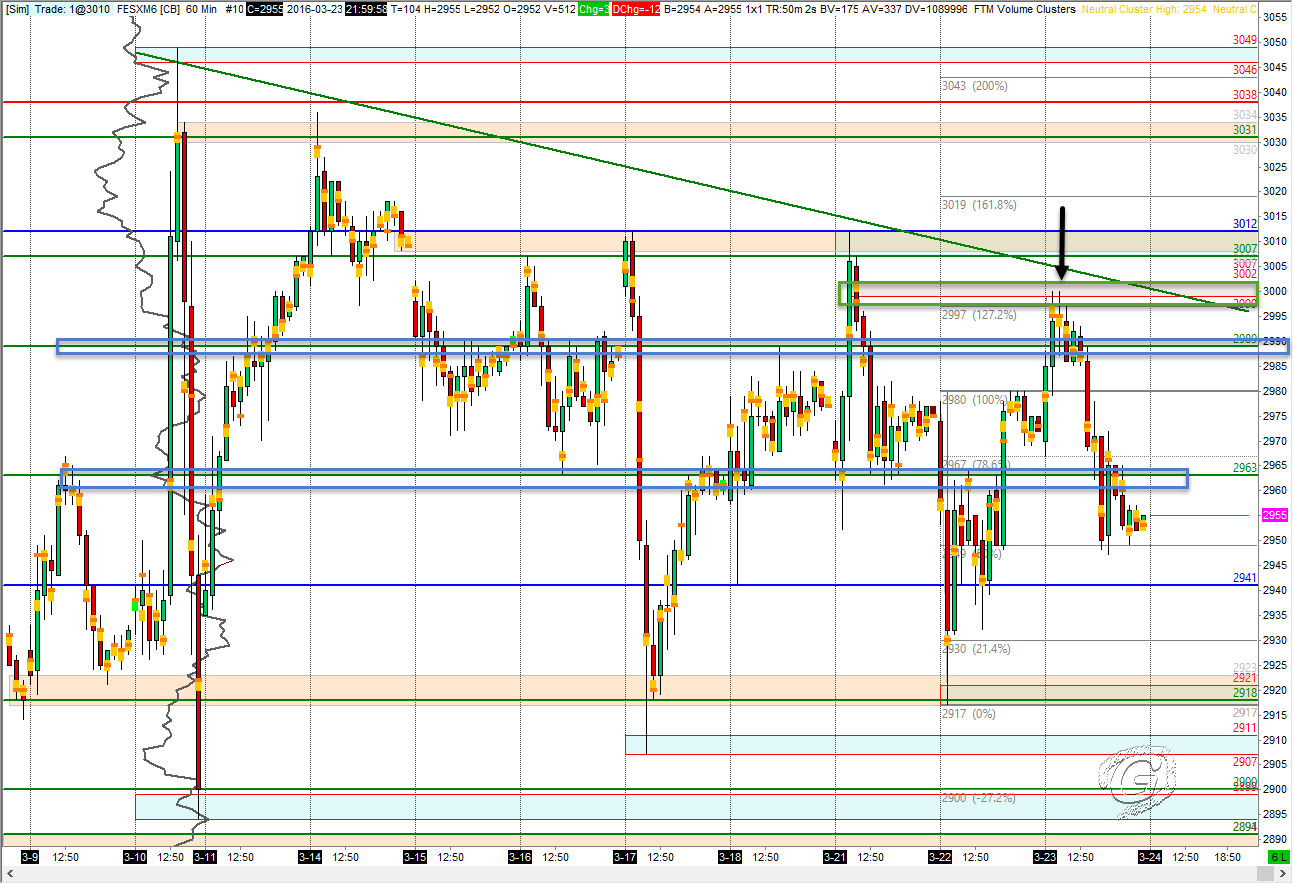

FESX 23 March 2016 EOD review

Refer to Pre Market post for key levels. Yesterday’s poor high was retested in the morning session, and stoxx reversed around 3000 which was also 127.2% extension of previous day’s range. It was a slow grinding morning session as you might have read from my tweets. #stoxx since open .. pic.twitter.com/fpSP78Vbrg — Gavin M™ (@tradergav) […]

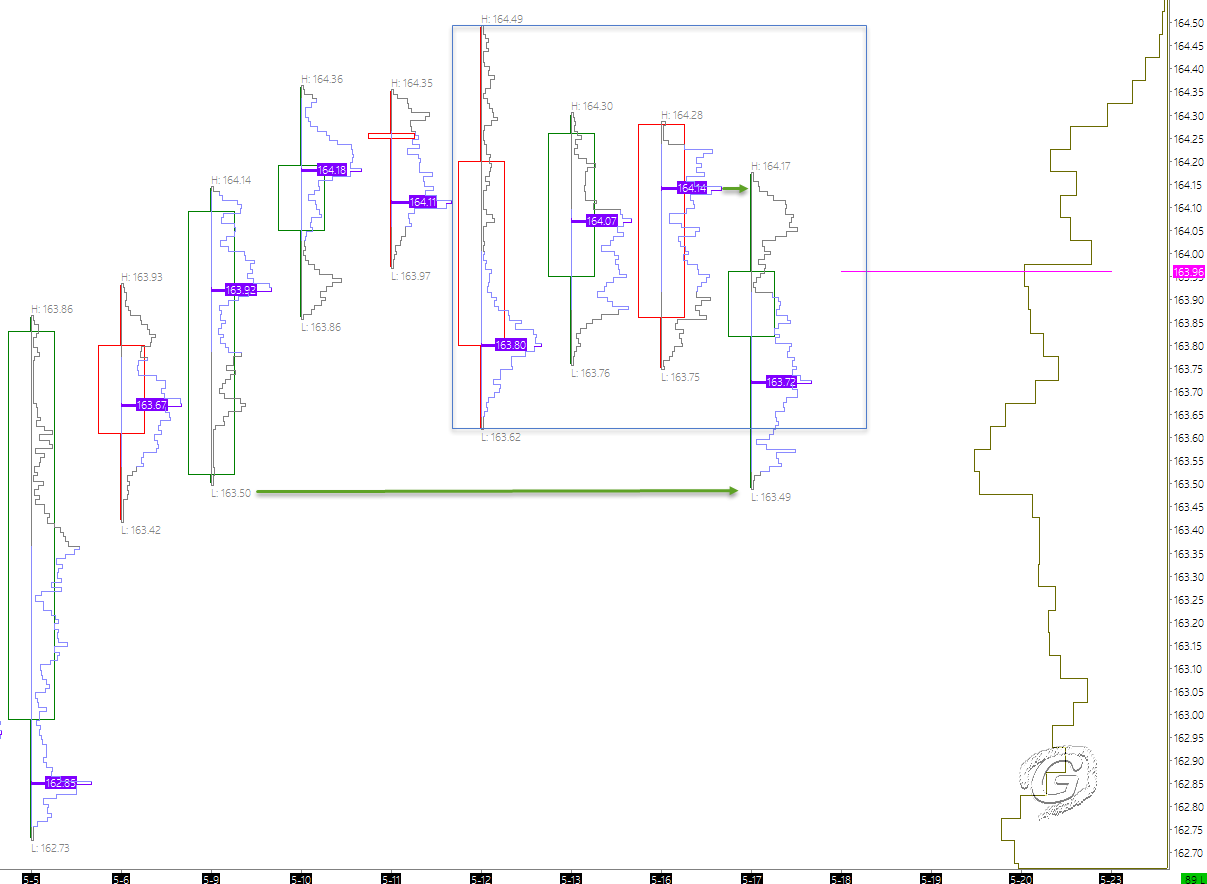

AUDUSD 23 March 2016 levels to watch

Here are the levels of interest for AUDUSD. Chart prepared using Sierra Chart.

Pre market FESX 23 March 2016

Yesterday, stoxx closed with poor high.

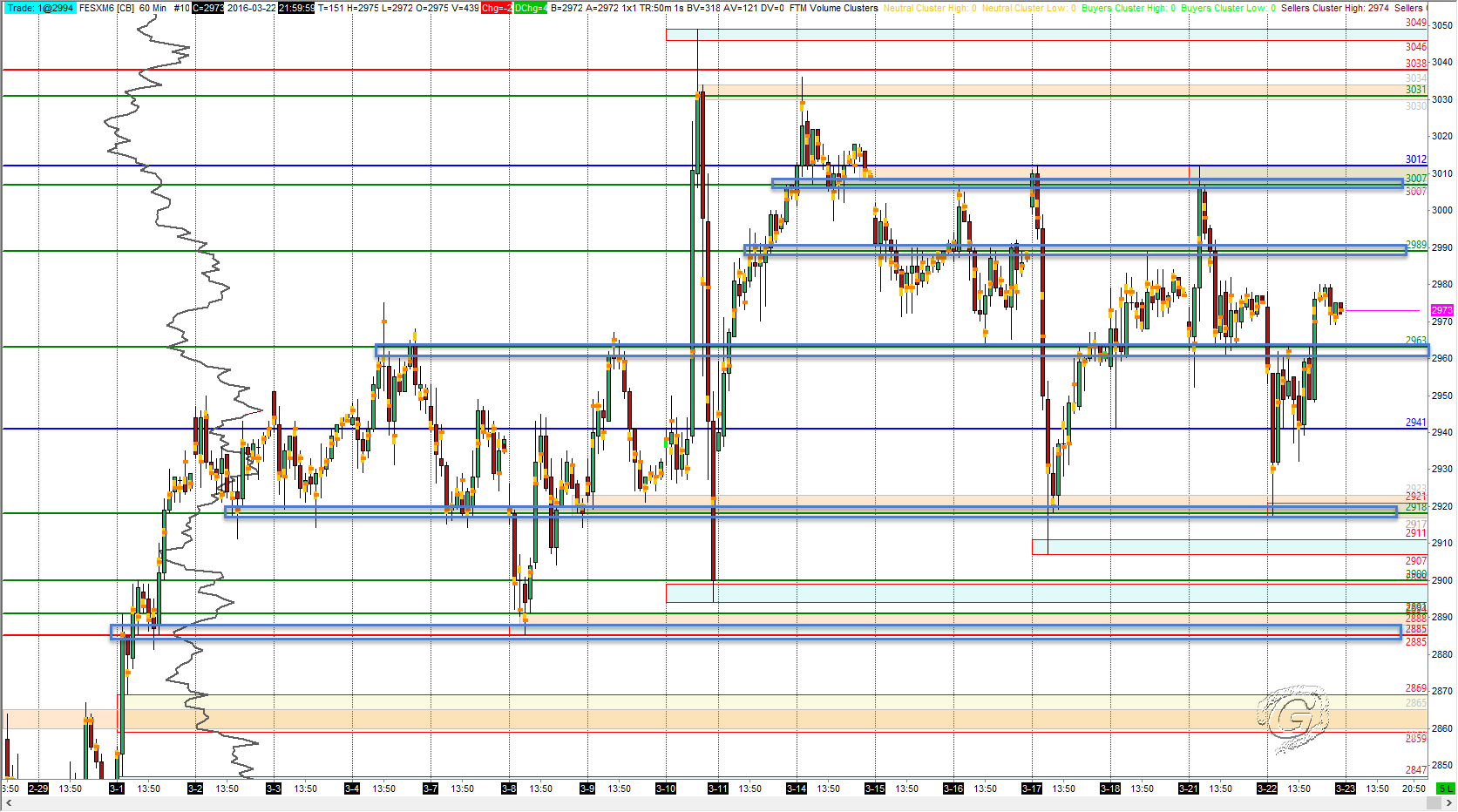

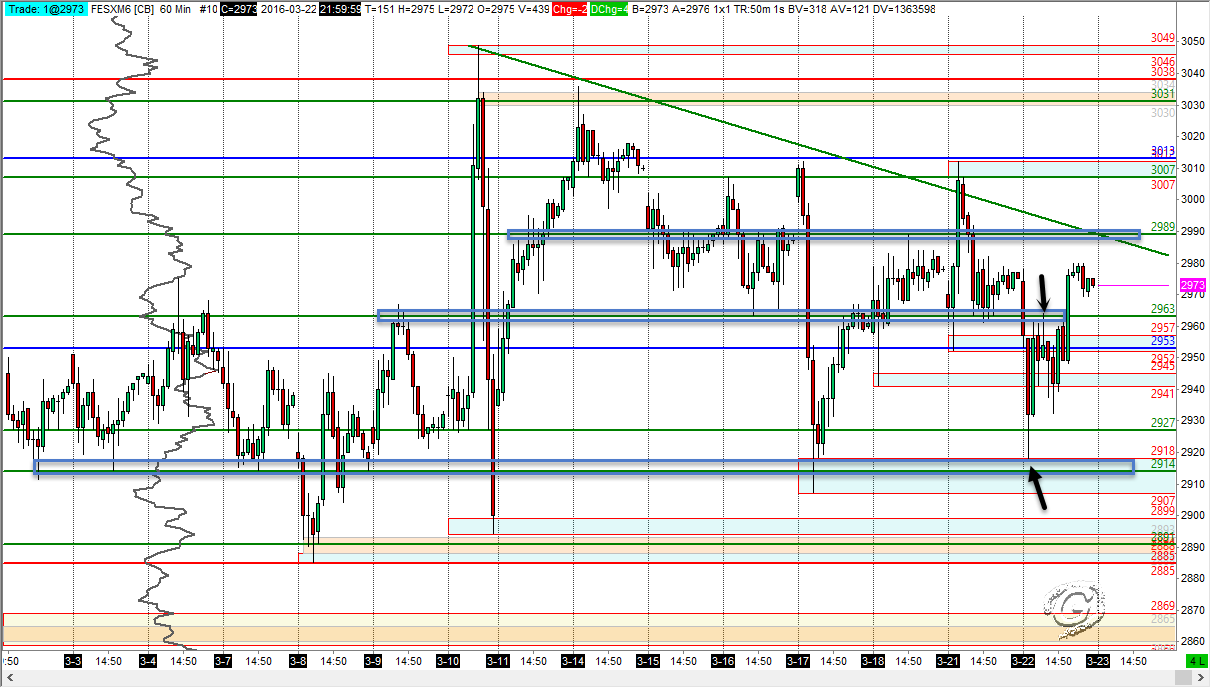

FESX 22 March 2016 EOD review

Previous day’s failed inside day break, and Brussel terrorist attack, stoxx was sold off initially, and recovered most of the day’s lost at the end of the day. Refer to pre market post. Here are the end of day Hourly chart.