I tweeted earlier about potential long opportunity of cable at 1.6130. This level will see the completion of a bullish harmonic formation, and it is also at the demand level which increase the odds of long position. Here is the …. CHART!

Harmonic setups

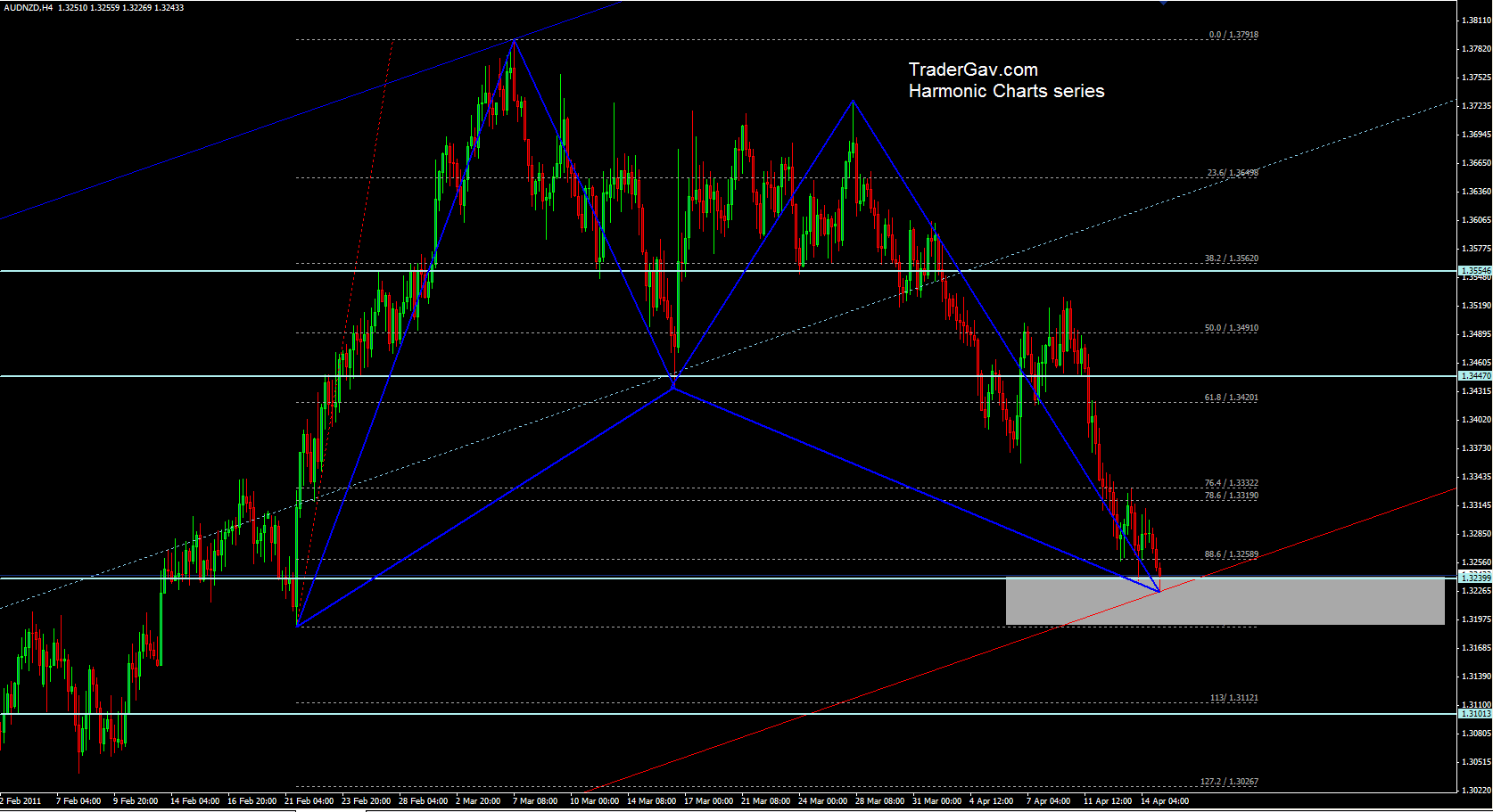

$AUDNZD 15 April 2011

Here is the chart I mentioned in my tweet. We have the completion of bullish harmonic formation, price reaching bottom of the channel and support level. Setup will be invalidated if 1.3180 level is broken. Here is the ….. CHART!

$EURGBP 13 April 2011

Here is the EURGBP chart I mentioned earlier on in my tweet. The pair has recently completed a Bearish ABCD formation, and it is trading right in the supply level. I am looking at the short side for now, and the setup will be invalidated above 0.8945. Here is the…. CHART!

$EURUSD 12 April 2011

I am playing my plan here. EURUSD has made highs, and finally reach my defined supply level and a bearish harmonic formation has completed in weekly chart. I am at the SHORT side now. Let’s see how it goes. Here is the ….. CHART!

$EURUSD 21 March 2011

Here is the Daily chart of EURUSD. Looking at it carefully, we are entering supply zone, and we have confluence of harmonic patterns, top of channel, and resistance level. I am watching closely for potential short opportunity. Let’s see how it goes.

$NZDUSD 15 Feb 2011

NZDUSD is currently trading in an interesting zone. We have a bullish harmonic formation and the confluence of key support levels, and daily rising trend line. If a bounce from here happens, I have two possible scenarios. 1st is a pull back and then continuation of bearish symmetrical movement (Refer to the yellow lines). 2nd […]