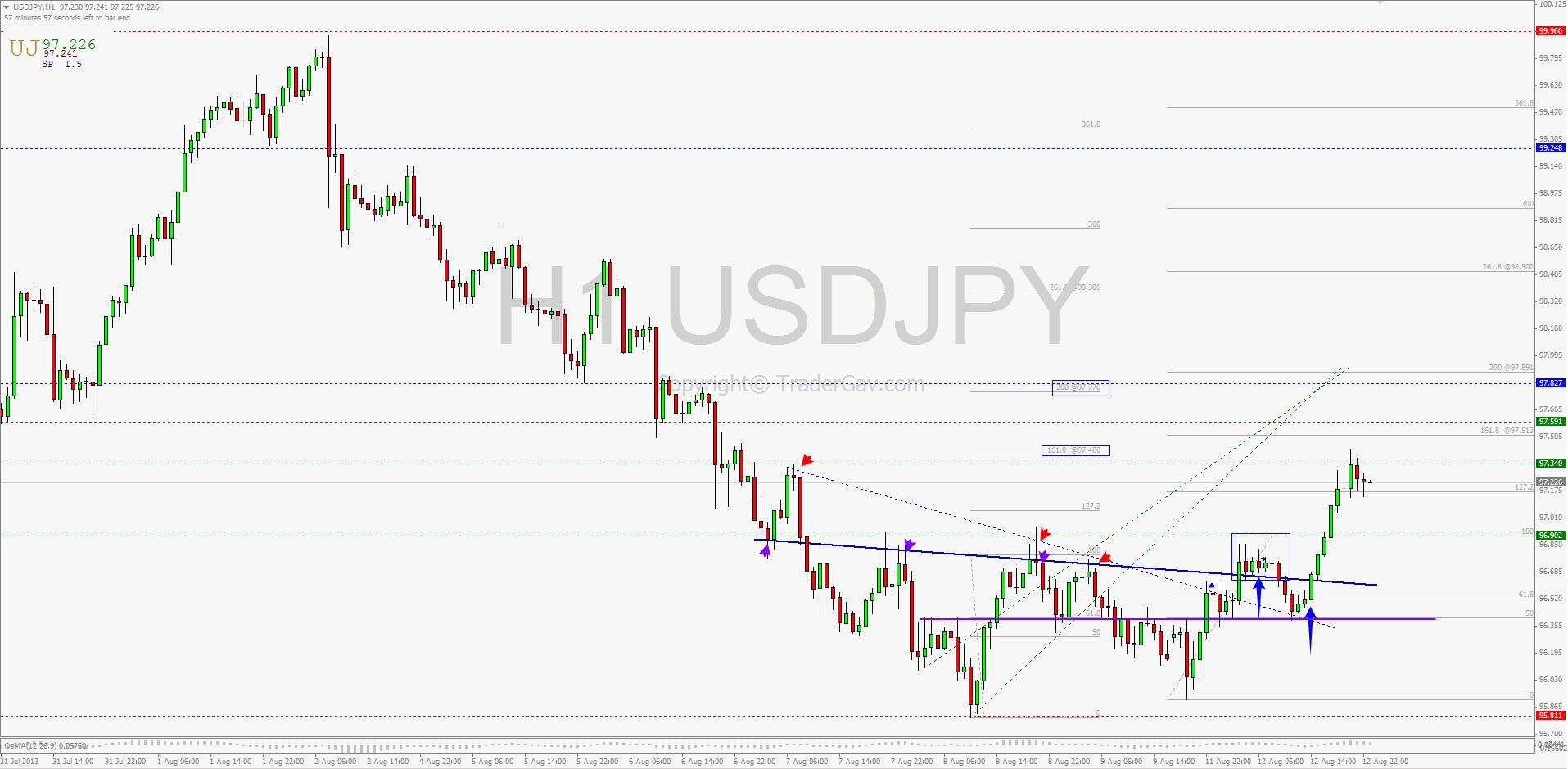

Just a quick post of one of the trades I made yesterday. I thought it might provide some educational value to my now 13 readers. I went long of USDJPY around mid London session yesterday. My entry was not the best I would like to have. I saw a small consolidation cluster around 96.75 , […]

headline post

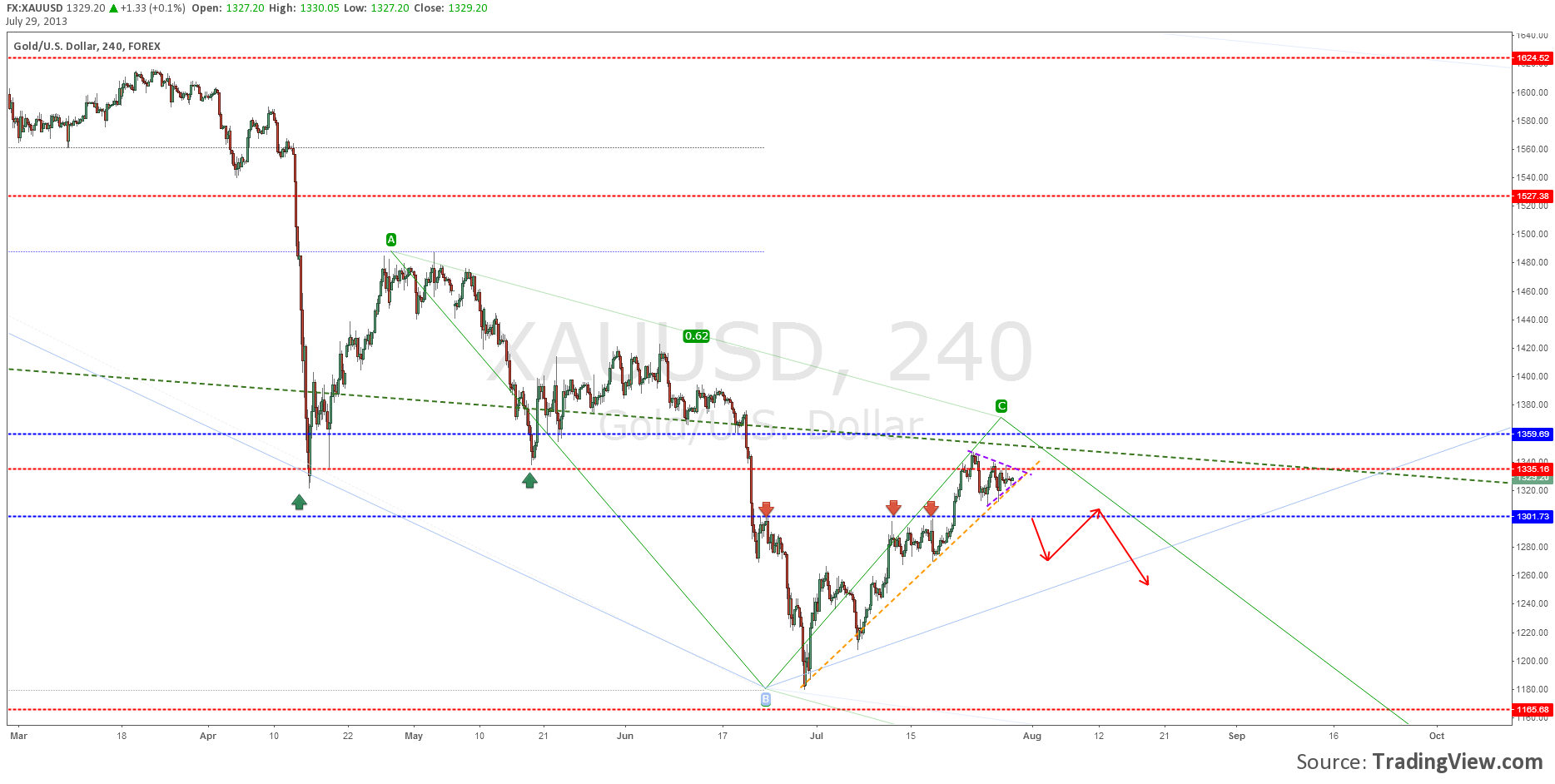

Weekly Review of GOLD (XAUUSD) 08 AUG 2013

GOLD reacted to resistance level and remain moving within daily down channel. There are some details to watch in lower time frame. Here is the weekly review of Spot Gold XAUUSD levels 05 August 2013

Weekly Review of GOLD (XAUUSD) 30 JUL 2013

In my previous post, we have identified the potential resistance zone around 1335. We are right there now. I would like to see a turn at this area, and projected target is at 1000 should the selling resumes. But, it is not as simple as it sounds. There are road blocks in front of us. […]

Waiting for the nobrainer trades AUDUSD USDJPY

AUDUSD Aussie remains trapped within the trading range. You can trade your range play strategies, I prefer to wait for nobrainer setups. 0.93 is still the key level to watch for any bullish movement. 0.9030 is the immediate support area to watch. A break of these levels will interest me. For short term intraday trading, […]

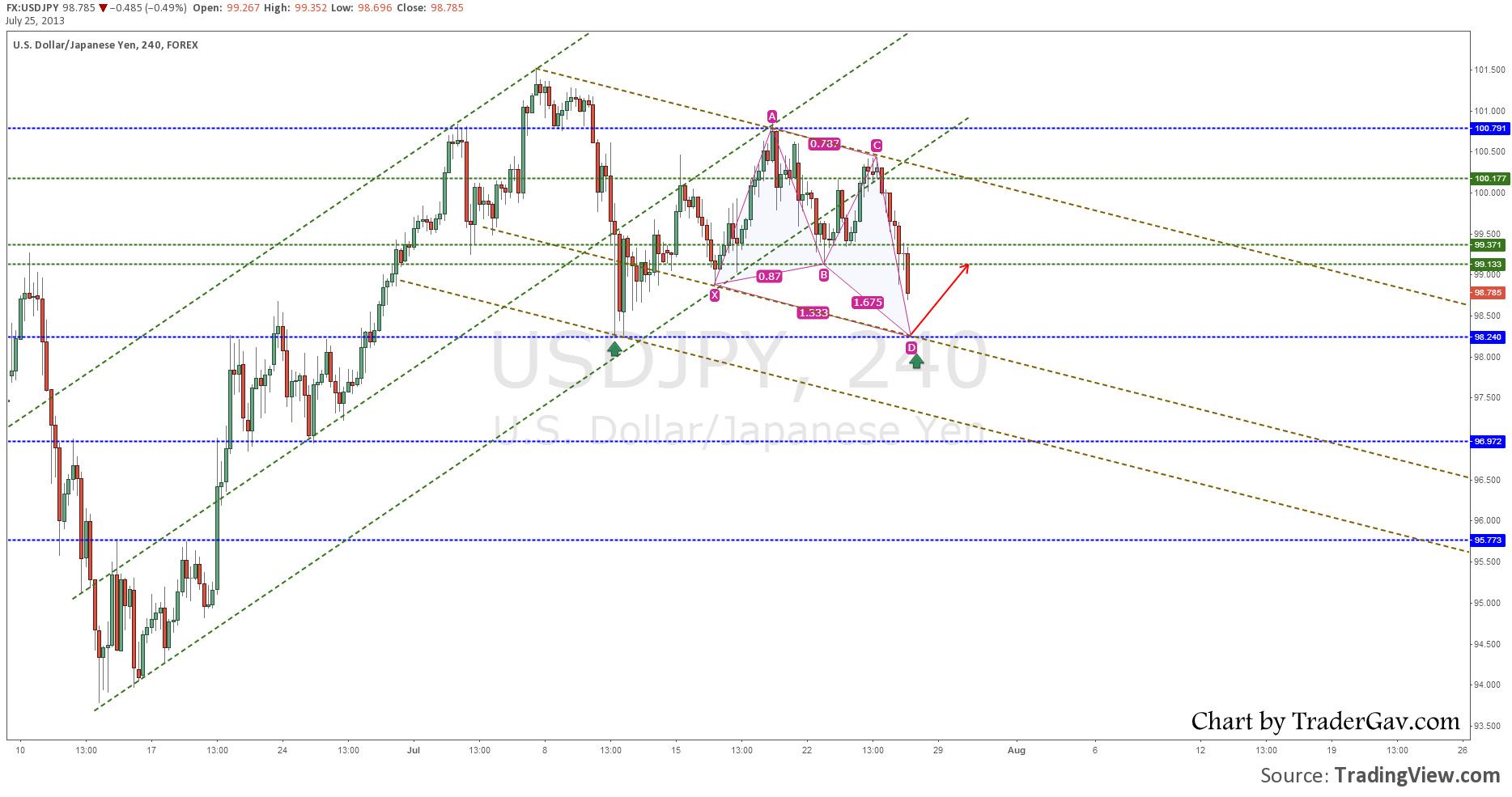

USDJPY level to watch 26 Jul 2013

USDJPY 98.25 is the immediate target for now. And this is also the level to watch for any potential bounce. I am interested in watching this level for potential false break before attempting long position.

The 7-year-old trading blog and new plan

TraderGav.com is now 7 years old! After trading and blogging for 7 years, the passion (or addiction!?) is just getting stronger. No sign of stopping. After having a brief hiatus and also working on other project, I have decided to revamp the site, reorganize the content, and redesign the look and feel. Here we have the […]