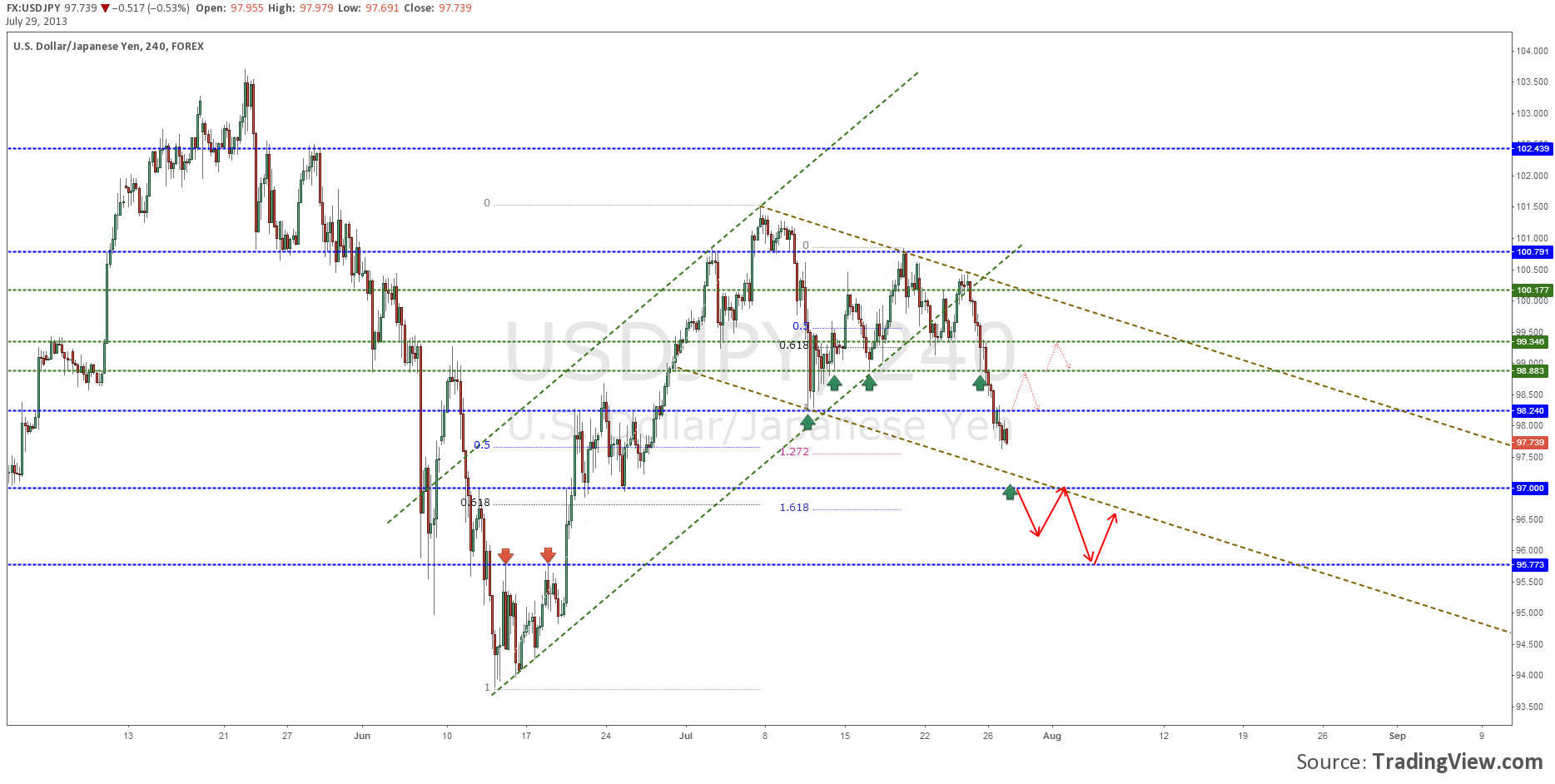

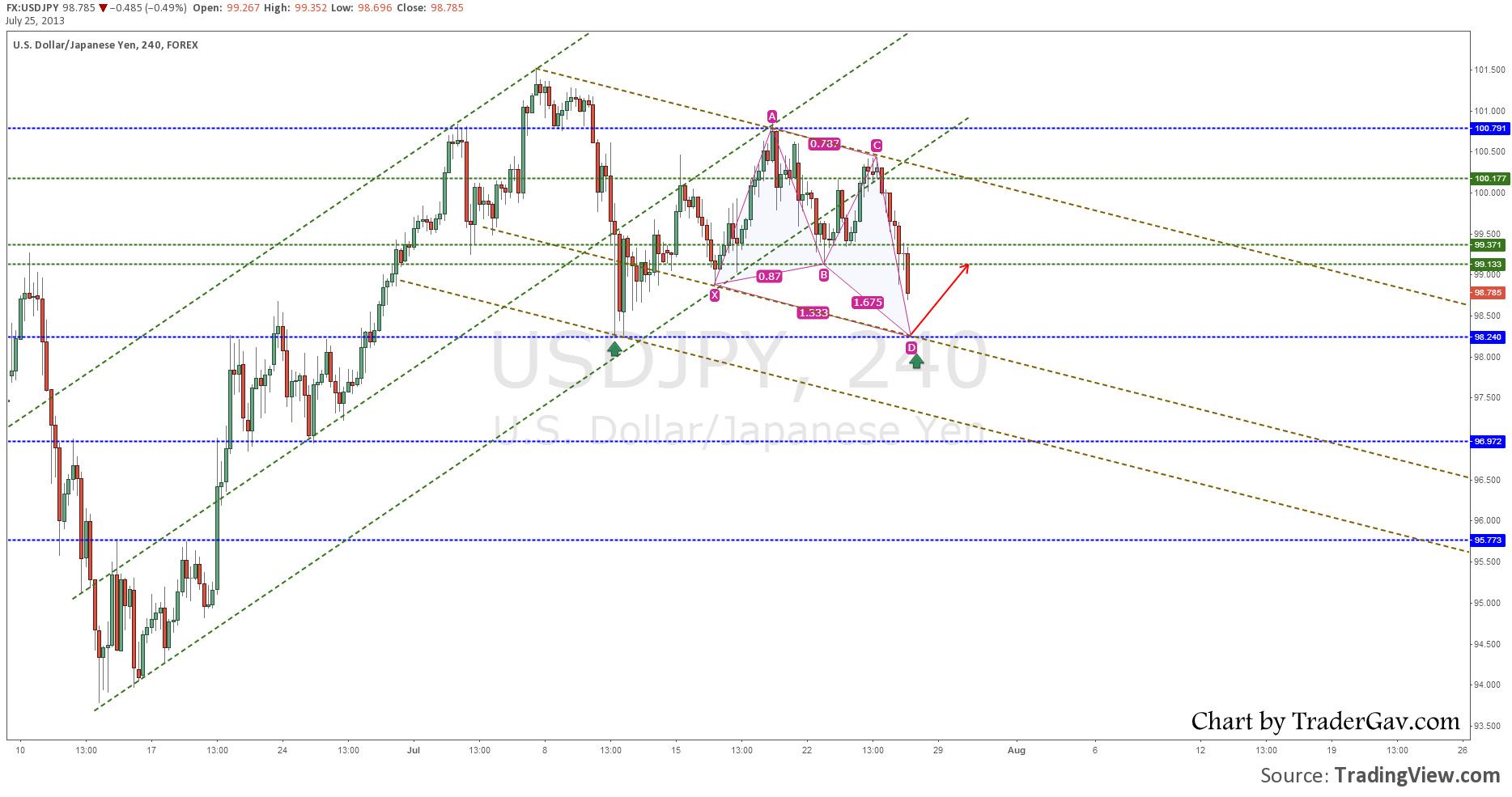

I thought I will write a quick follow up of the USDJPY development. Well, in the bigger picture, price is still trading within the channel as shown in my previous post Here and Here. However, there are some developments in Hourly time frame which I can use to show how I approach the levels. This is definitely not a post to show off how many hundreds of micro, nano pips that I have gained nor to whine about missing/losing trades.

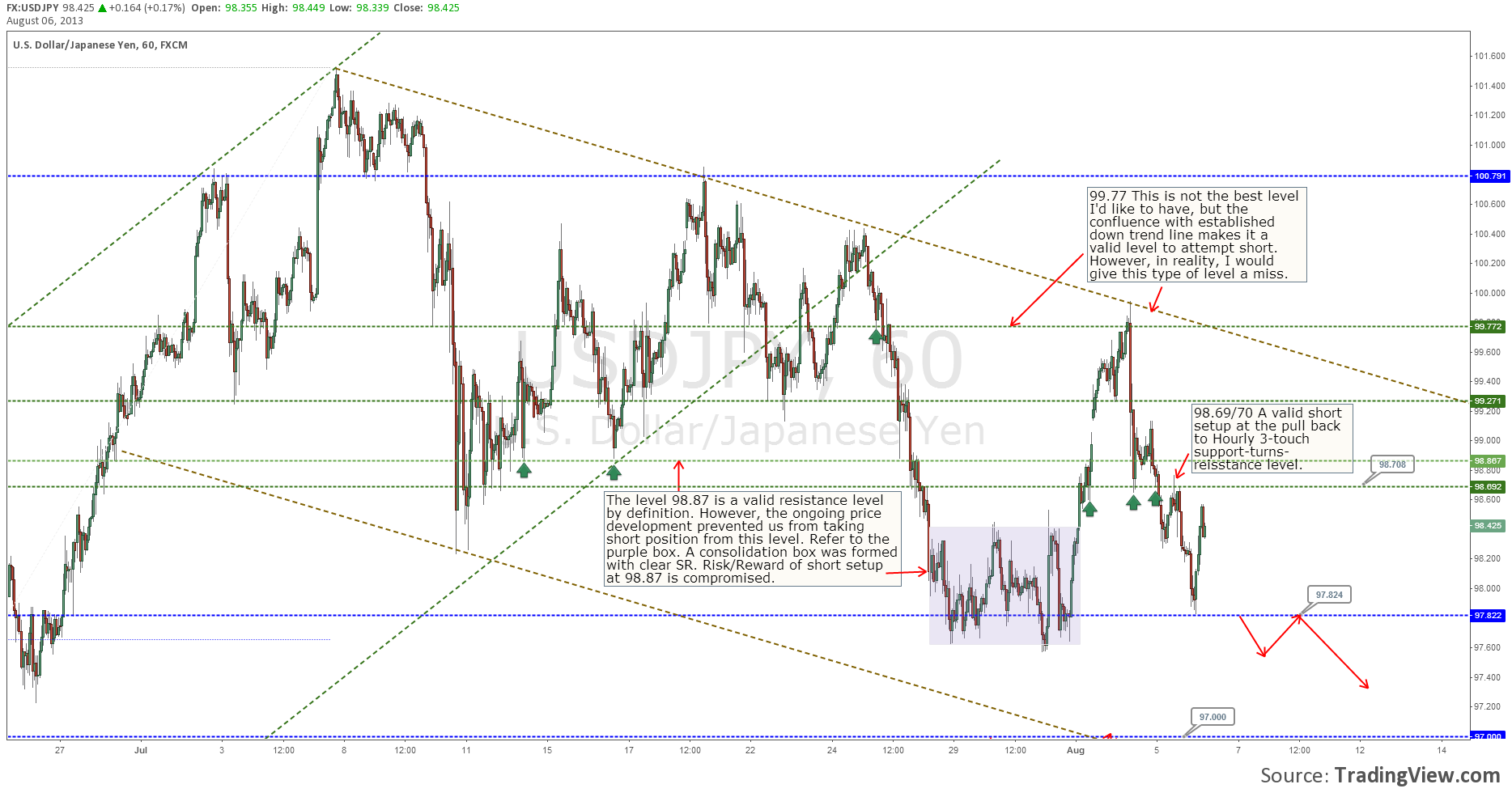

Anyway, I have annotate the chart with my comments. Hopefully it helps some of my 12 readers.

The key notes here are:

- The importance of observing on-going price development A valid level is not taken due to risk/reward ratio has been compromised. This happens when a price does not continue selling (or buying) as expected, instead it creates a base with forming new support and resistance levels.

- When a level is not the strongest according to our plan, always look for more confluence factors.

Here is the hourly chart of USDJPY (click to magnify the chart)

Leave me a comment for any question you might have.

From the desk of TraderGav.com