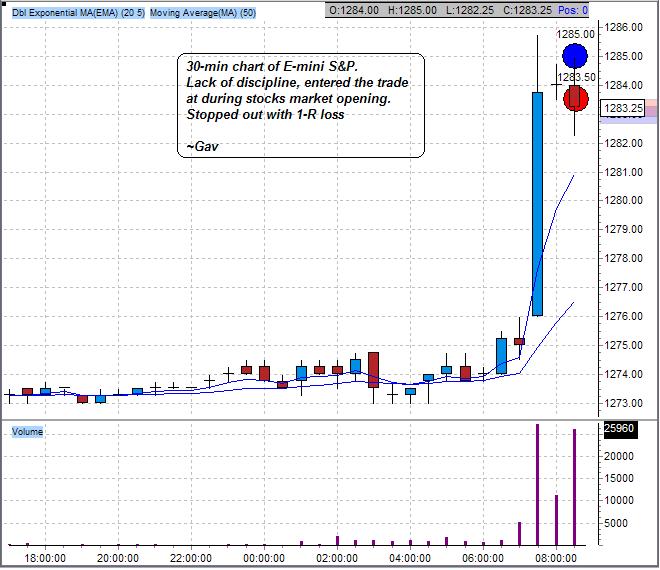

First trade of the day was a loss, and I was a loser. However, I deserved the loss. It was the result of lack of discipline to follow my trading rules, that is never enter a trade during the first hour of stocks market opening. I was eager to enter Long trade of E-mini S&P given S&P futures/Dow/Nasdaq are having good gain after Core PPI number released.

One trade closed with 1-R loss. Though the R is very small for this trade, the result shows a serious discipline and trading mentality problem.

[photopress:30_min_Emini_SP_trade_closed.JPG,full,pp_image]