Here are the charts for 23 March 2018 with zones of interest marked. Markets covered: 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract Basic Principle = Trade Location → Order Flow→Execution

Blog and Rants

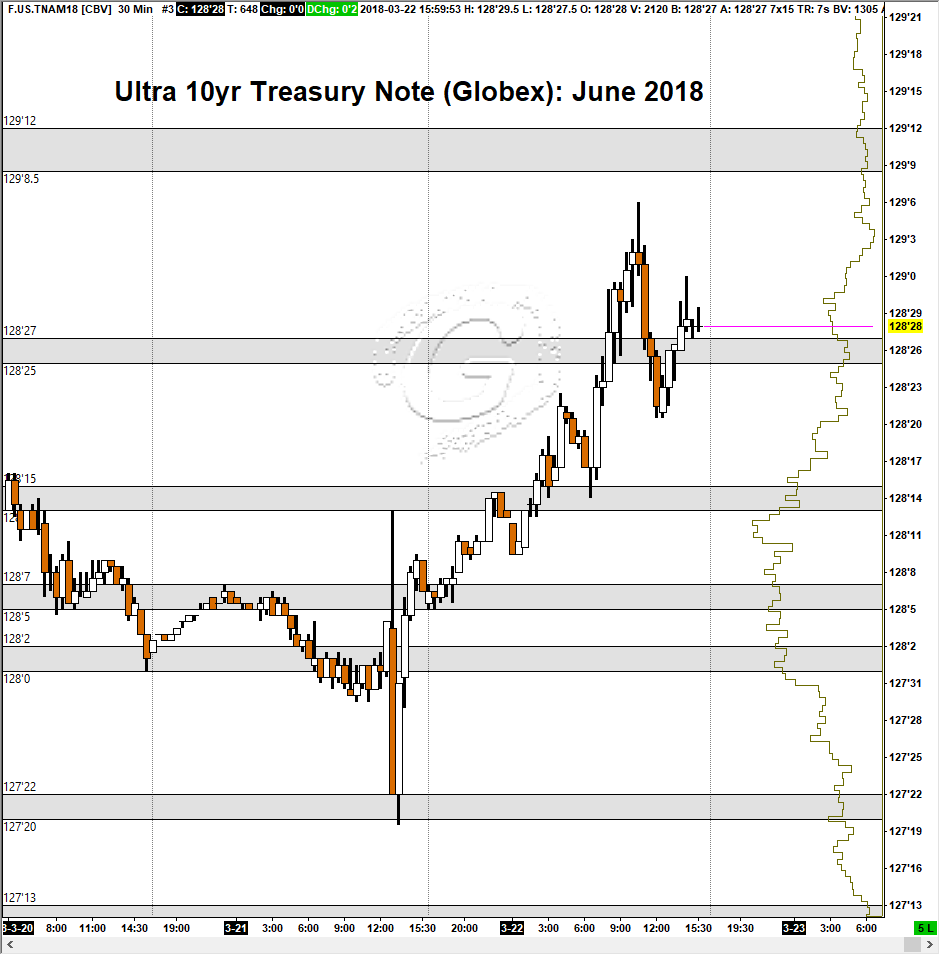

EOD Recap 22 March 2018

Refer to pre market prep post here. Here are the EOD reviewed Charts. Markets covered: 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract The basic principle is Trade Location (zone) → Order flow analysis →execution

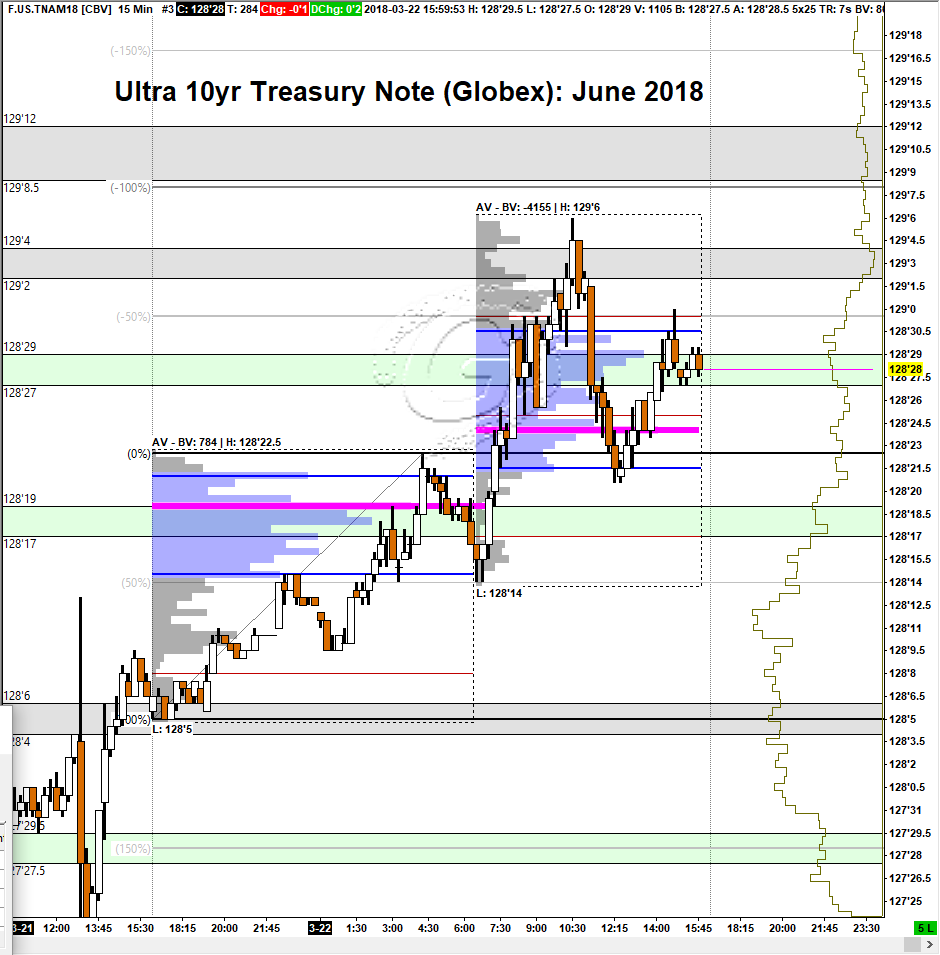

Market Prep 22 Mar 2018 zone of interest

Here are the charts for 22 March 2018 with zones of interest marked. Markets covered: 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract Basic Principle = Trade Location → Order Flow→Execution

EOD Recap 21 March 2018

Refer to pre market prep post here. Here are the EOD reviewed Charts. Markets covered: 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract The basic principle is Trade Location (zone) → Order flow analysis →execution

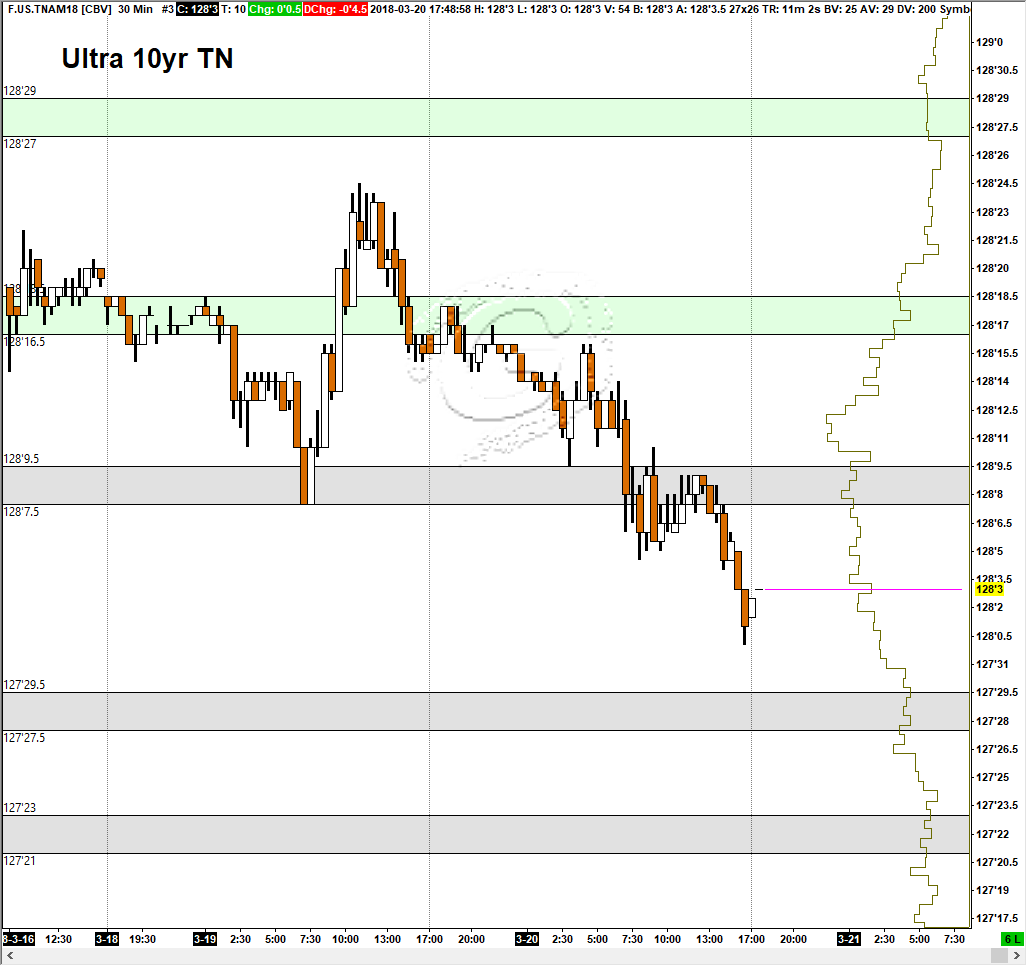

Market Prep 21 Mar 2018 zone of interest

Here are the charts for 21 March 2018 with zones of interest marked. Markets covered: 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract Basic Principle = Trade Location → Order Flow→Execution

EOD Recap 20 March 2018

Refer to pre market prep post here. Here are the EOD reviewed Charts. Markets covered: 30yr US Treasury Bonds – ZB June 18 Contract Ultra T-Bond- UB June 18 Contract 10yr US Treasury Notes – ZN June 18 Contract Ultra 10yr US Treasury Note – TN June 18 Contract The basic principle is Trade Location […]