This is not new, some of my readers might have already watched it before. I thought the interview is interesting. And, man, I like his office setup 🙂

Reading materials: Elliot Wave

I recently become a fan of Scribd.com. There are some really good reading materials contributed by the community. I have filled my Amazon Kindlewith some new books and this should be enough for my ‘consumption’ during my trip.

Here is one about Elliot wave theory. While, I am not EW practitioner, I do read about their theory. It is good to have understanding about different trading style. Anyway, I need to clarify that I am not the publisher of this book, but just using the sharing functionality provided by Scribd.com.

Elliot Wave Course

In addition, To learn more about Elliot wave, you might want to check out the free reports The ultimate technical analysis handbook and How to use bar patterns to spot trade setup by EWI

Using Evernote to create trading journal

I don’t have trade to share today, instead, I am thinking of sharing the ‘tool of the day’ to my readers 🙂 . I have recently start using Evernote on my iPhone and laptop as my digital assistant. And today, I thought I would try to integrate the tool to my daily routine – market review, and journaling. And, I am truly impressed by the tool.

Here is a short video clip I have created.

Use evernote to create trading journal

And you can login to Evernote’s website to view your saved journals from any computer, or read it from your mobile phone. Here is the snapshot of my iPhone.

I love the tool. And , this is my personal review of Evernote, and I am no affiliate to them. Just another tool to share, check it out.

Trade of the day 30 June 2010: $AUDUSD Long

Hello from Jakarta, Indonesia. I will be trading from here for the next couple of weeks. All right, back to business. I was looking at AUDUSD to rebound from 85 level. It did, however, it did not meet my final profit target, and, hell, I made an unusual panic exit today. Not impressed by myself.

Anyway, I thought the chart looks beautiful and it is worth sharing. This trade was off 5-minute chart, as I didn’t find a better stop level in bigger time frame today.

Here is the… CHART!

Weekend video 26 June 2010

This is for your weekend. One of my favorite fighting scene from the movie <<?? 2>>. Check it out.

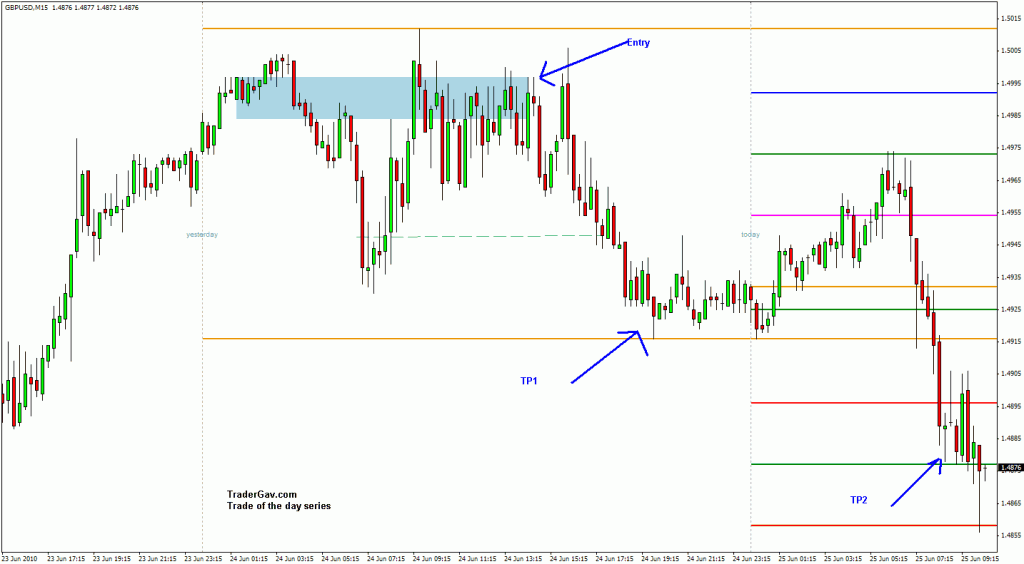

Trade of the day 25 June 2010: $GBPUSD short

I have made some mistakes this week, well, stupid mistakes. Anyway, I think one of the essential trading skills is to learn how to pull yourself back after making mistakes, and bad trades. Anyway, enough crying like a kid, I am still trading throughout the week. I thought the $GBPUSD short is worth sharing here.

I entered the short position near 1.5 area since Thursday session, 2 profit targets were achieved. This is not an easy trade, price was swinging around before actually moving in my favor.

Here is the…. CHART.