Like it or not, the market spends more time moving sideway than trending. Mean Reversion is the strategy that is made for choppy price action.

In this blog post, I want to show you what a Mean Reversion Trading Strategy and how to implement it in your trading.

What is Mean Reversion Trading Strategy

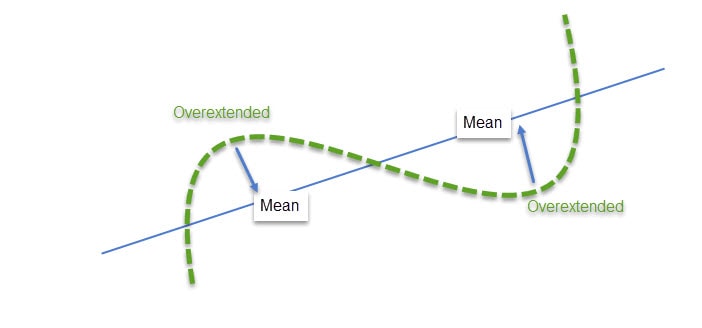

Mean Reversion trading strategy is based on the concept that price tends to snap back to the mean or fair price.

Traders initiate trades when the market is deemed to be overextended. In other words, we trade the market that is well above or below their respective “fair value”.

In contrast to the trend-following strategy, Mean Reversion works well during the choppy and volatile market conditions. During this condition, we expect the price to snap back to mean quickly.

The Danger of Mean Reversion Trading

Mean reversion strategy traders often get killed when a new trend emerges. The market could continue moving without going back to the mean in an extended period of time.

Mean reversion traders get flushed out during the trending market.

Secondly, the mean reversion strategy requires a slightly wider stop loss. You need to give the position space to breathe before it snaps back to mean.

You can’t perfectly time the market. But you can manage your trade to deal with the change.

Mean Reversion could be a useful trading strategy if you manage your risk well.

Below, let’s look at some important components when designing a Mean Reversion trading strategy.

Components of a Mean Reversion Strategy

To design a mean reversion strategy, I always keep the following 4 components in mind.

#1 Fair Value

There are many ways to define the Fair Value of your trading strategy. A mean could be (but not limited to):

- Volume Point of Control

- Moving average (long term average price)

- VWAP

- Pivot Point

#2 Overextended zones

These are the areas that markets are oversold or overbought. Depending on the Fair value, the definition of the overextended zones varied.

Here are some examples for you to work on:

- For Volume Point Control, value area high low could be used as overextended zones.

- For Moving Average or VWAP, standard deviation bands could be used as overextended zones.

- If the Pivot point is used as a mean, pivot support/resistance levels could be used as overextended zones.

These are not rules, but some examples for your reference. I hope you get the ideas.

#3 Entry Methods

There are a few entry methods traders could apply to enhance our odds of success. Candlesticks patterns, order flow analysis, or indicators divergence are some of the most popular entry methods.

The point is to find the exhaustion of price at the overextended zones for better entry timing.

#4 Exit points

Regardless of the indicator you use, you will encounter the situation where price keeps on moving in the extended direction without pulling back to the mean. The new trend has formed.

Just like all trading strategies, it is crucial to define the stop levels and profit-taking. As an example, you could use the ATR (Average True Range) for stop levels, and the Mean levels as profit taking points.

Examples of Mean Reversion Strategy Implementation

Here are a few mean reversion strategies you can study.

Bollinger Bands

Bollinger Bands is a popular indicator used to implement Mean Reversion strategy. Bollinger Bands are constructed by moving average and standard deviation bands.

A Simple strategy could be built using Bollinger Bands:

- Moving Average as the mean (fair price)

- Standard deviation bands as the overextended zones

- To time the entry, RSI or Stochastics oversold and overbought zones could be used as triggers.

Keltner Channels

Keltner channels are very similar to Bollinger bands. It consists of an exponential moving average and average true range bands.

The implementation is similar to Bollinger Bands.

VWAP

VWAP is another popular technical indicator used for Mean Reversion trading strategy.

VWAP is constructed using a typical price and volume. To implement the Mean Reversion strategy, we can calculate standard deviation bands.

If you are a Tradingview user, make sure to check out my free VWAP standard deviation bands indicator.

Try Tradingview Pro Charting Platform For 30 days

Tradingview is my go-to FX charting and trading solution. I have done extensive coding and trading on the platform. I am happy to recommend them.

If you are interested in using Tradingview, you can try out the Pro membership FREE for 30 days. This is an excellent time to check out the powerful features of Tradingview charting.

Closing Words

We are always told to trade with the trend. It is true. But the fact is, the market spends more time moving sideways. Mean Reversion Trading strategy could fill the void.

Take the examples above, look deeper to see if it can fit into your trading systems.

If you are interested in learning more about trading, make sure to check out my Back to Basics of Trading series.

Wow….Such a great article. I learn many things from here. This article will be fruitful for the traders. Well done. Thank You.