I have been working on coding my indicator and strategy on tradingview lately. I thought I would write a short post related to trading with indicators.

There is no shame or a sin using an indicator to trade. Our brains are wired differently.

Some of us can do quick math and analysis on the fly. Some of us rely on graphical presentations to make a decision.

If you have to use a technical indicator or indicators in your chart analysis, I have a few suggestions for you.

Trading with Indicators – 4 Suggestions

#1 Understand the math behind the indicator.

I can’t stress enough the importance of understanding the math behind any technical indicator that you are about to use.

You do not need to be a math genius. You do need to be able to understand basic math operations.

A technical indicator is basically a mathematical blend of data.

We receive open, high, low, close, and volume as the raw data on our chart. We can calculate the average of closing prices, finding the highest volume, or calculating the differences of mean, etc.

What is a moving average? It is the average closing price over a defined period. And What about MACD? It is the difference between long term and short term moving average.

You got what I mean? Indicators are the calculations of the raw data. Each calculation serves a purpose.

Why would you want to use a tool that you don’t understand to help you make financial decisions?

#2 Trade location first, indicator triggers second

Oh boy, the crossover of any lines on the chart always gets traders excited, isn’t it?

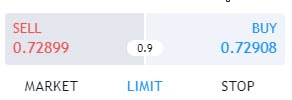

Hang on, don’t click that “Buy/Sell” button just yet.

One of the most common mistakes an indicator-trader makes is to follow the trigger signal blindly.

What is the secret of using an indicator trigger effectively?

Trade location.

Over the years of trading and learning, it was the recognition of trade location that turns my trading around.

What is a trade location?

A trade location is an area that is derived from the market structure. Traders are expected to take action at these locations.

A trade location could be a major support and resistance area, high/low volume node of volume profile, borders or trading range, or major swing high/low, etc.

Knowing a potential trade location gives you an edge. But knowing the location alone is not enough. You have to work on your entry technique.

There are many entry techniques. For example, in Futures trading, I am using order flow, while in Forex I have candlesticks patterns and other indicators to help me.

Same thing goes for indicators. After you have identified a valid trade location, a trigger of indicator might give you a good entry.

The point is, don’t use indicators alone. Use it to your advantage.

#3 Indicator, the less is more

One of the common mistakes newbie traders tend to make is having way too many indicators on a chart.

By stuffing the chart with indicators, you are complicating the decision making process. And to worsen the situation, indicators give you conflicting signals.

Try to limit the number of indicators on the chart. The lesser the better. Trying to simplify your decision making process is the key.

#4 Create your own indicator

I encourage you to create your own indicator. Why? Because it is a great learning experience.

By working on the code and the logic, you will learn to look at market data quantitatively. You will learn to understand the market you are trading better.

I always enjoy working on my own technical indicator. It gives me the focus I need, and helps to prove the concepts I have in mind.

You don’t need to create an indicator to start trading. Just take this exercise for the sake of learning.

Trading with indicator – Closing words

There is absolutely nothing wrong with trading with indicators. If it helps your trading, by all means, using it.

Having an indicator on your chart does not make you less professional.

Trading involves a series of decision making. From trade entry, to management, and to exit a trade. It involves different skill sets.

Indicator is one of the tools that can potentially help us in the decision making process. I hope the suggestions above help you to use your indicator more effectively.

If you are interested in learning more about trading, make sure to check out my Back to Basics series.

Do you use an indicator in trading? How do you use them?

Do you have any questions or comments? Feel free to drop me a line in the comment section.

I posted a question on VWAP two days ago. Where do I go to see if any response?