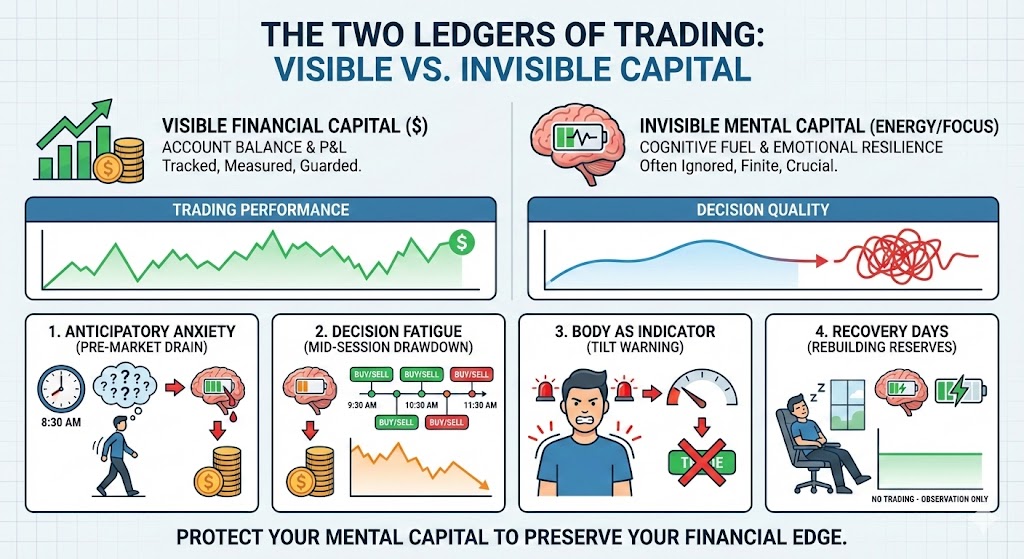

We spend most of our time staring at one ledger.

We track the account balance. We obsess over the P&L. We calculate the risk of ruin and the potential reward.

But I noticed years ago that there is a second ledger. It is invisible, but it dictates the movement of the first one.

This is your mental capital.

We treat money as a scarce resource, yet we treat our focus and emotional energy as if they are infinite. They are not.

When I review my trading journals, the losses rarely come from a lack of technical knowledge. They come from a bankruptcy in mental energy.

Here is how I learned to track the invisible capital.

The Cost of Anticipatory Anxiety

I used to sit at the desk an hour before the open.

I would stare at the pre-market data. I would run scenarios in my head. I would worry about positions I had not even taken yet.

By the time the opening bell rang, I was already exhausted.

I had spent my mental capital on “what if” scenarios that never happened.

It is like a runner sprinting laps in the parking lot before the marathon begins. You are burning fuel that you need for the race.

I learned to condense my pre-market routine. I do not sit at the screen until I need to. I preserve the fuel for the execution.

Decision Fatigue as a Drawdown

There is a limit to how many high-quality decisions you can make in a day.

Every choice consumes energy.

Entering a trade is a choice. Managing a stop is a choice. Deciding to do nothing is a choice.

I noticed a pattern in my logs. My execution quality dropped significantly after the first two hours of the session.

The market was still moving, but my internal system was lagging. The friction increased.

I view decision fatigue as a drawdown. Just as you stop trading when you hit your max financial loss, you must stop trading when you hit your max decision load.

Now, I often stop trading after two hours. It protects the invisible capital for tomorrow.

The Body as an Indicator

The mind lies. It will tell you that you are fine. It will tell you that you can take one more trade to make back the loss.

The body tells the truth.

I started treating physical sensations as indicators on a chart.

A clenched jaw is a signal. Holding my breath is a signal. Leaning too close to the monitor is a signal.

These are the early warning signs of “tilt.” They appear long before I make a reckless trade.

When I see these signals, I do not push through. I treat them like a break in market structure. I step away.

Recovery Days

If you sprain your ankle while running, you do not go back out and run 10 kilometers the next day. You rest. You rehabilitate.

Yet, when traders take a significant psychological hit, they often try to return immediately. They want to make the money back.

This is a mistake.

A heavy loss depletes your invisible capital. You are emotionally injured.

I learned to implement recovery days. If I have a damaging session, the next day is for observation only.

I do not trade. I watch. I rebuild the reserve.

Trading is an endurance sport, not a sprint. The goal is to stay in the game long enough for your edge to play out.

You cannot do that if your invisible account is empty.

Protect your energy as fiercely as you protect your equity.

Keep refining your edge.

Leave a Reply