I love this chart. What do you see in this chart? Have a great trading week ahead!

Trading Journal

Updates, Social Networking shutdown & U.S Open

First of all, I am actually enjoying my current social networking shut down mode. I have not logged into Twitter for a week or so. And I don’t feel anything missing nor I miss anything. So, let’s see when I feel like tweeting again. Never mind, who cares? Trading front, nothing new, I am still […]

Saturday, updates

I am holding my short position of EURGBP right now. This is an interesting trade, probably because of the intense converstation between me and Davidpotts on Twitter. He is out from the position now while I am still holding on. Let’s see how it works out. So far, I am still convinced that EURGBP is overbought. […]

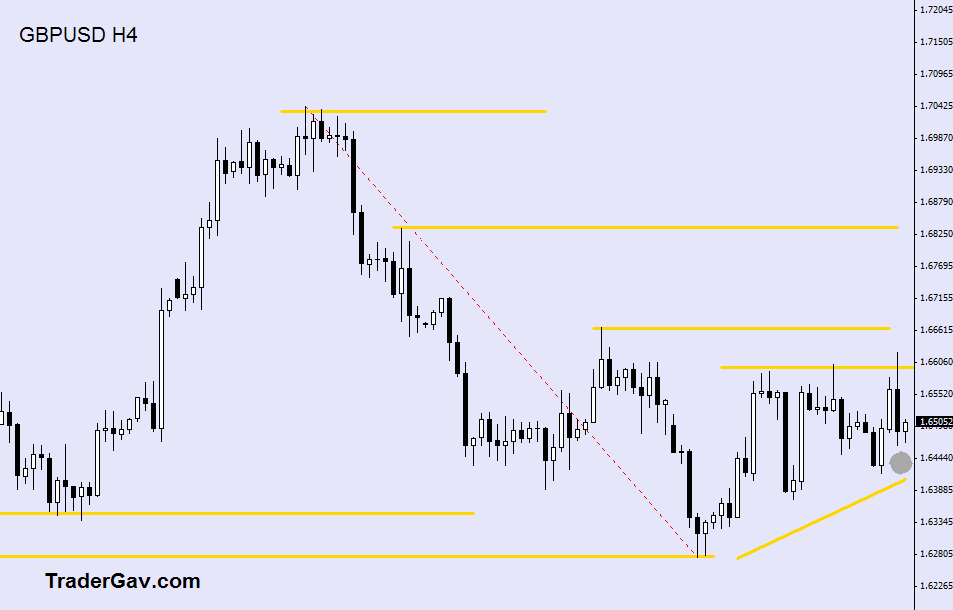

Buying some $GBPUSD 24-August-2009

This is the setup I am looking at the moment. Let’s see how it works out. I am looking at buying some GBPUSD should the price retrace and trade around 1.6450. And first target at 1.67. Here is the …. CHART

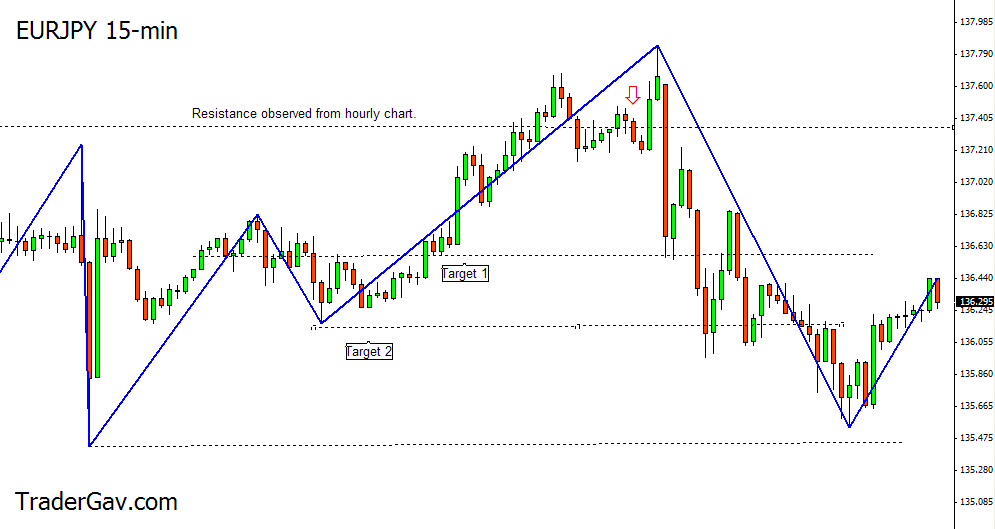

One day trade: $EURJPY Short 13-August-2009

As I’ve mentioned in Twitter, I saw a day trade opportunity to short EURJPY(FOREX:EURJPY). The trade went well, though I did not expect the aggressive selling. Very simple setup, playing with support resistance levels in bigger time frame, and day trade in 15-min chart. I do not make too many of short term trade like […]

Update of business and trading 13 August 2009

I am still actively trading. The main project I am working on now is enhancing my trading and risk plan, increase R size, increase my account size, changing broker and platform. The basic idea is not to tweak my current strategy since it has been serving me well, so, I do not wish to tweak […]