IHF (read: I Hate Forex) system went long of NZDUSD on Monday, and it was a crap. Stopped. And It went short on Tuesday. Another +130 pips trade. Nice short. Exited the trade at 0.52-ish level. Well, I maybe wrong, but who cares. Let’s wait for next signal.

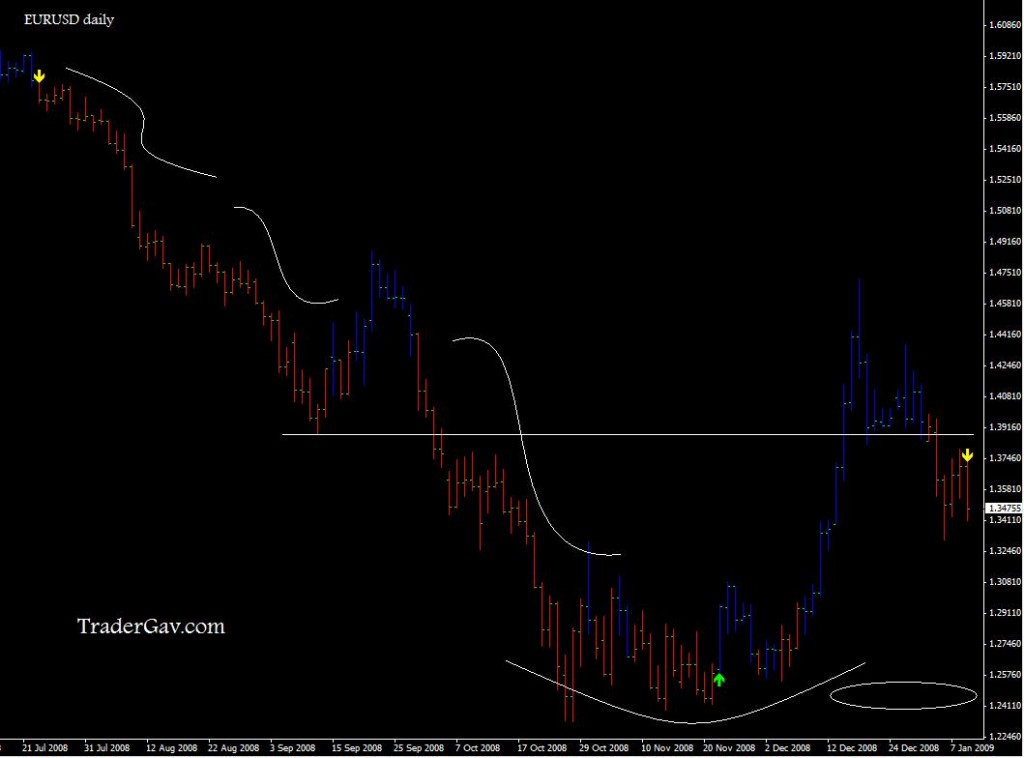

Here is the chart to inspire you, my little trader.