I am obviously at the wrong side of market this week. So, before any serious damage , I decided to stop my car for a while, and enjoy watching. 😆

I am obviously at the wrong side of market this week. So, before any serious damage , I decided to stop my car for a while, and enjoy watching. 😆

We saw a pretty good run of British Pounds crosses recently. However, good things seem to come to an end. I saw bearishness across GBP crosses. Looking at the bigger time frame of GBPUSD (i.e daily and weekly), now might be the time for down trend to resume. For short term trading (1 to 2 day time span), I am looking at EURGBP Long, GBPAUD and GBPCHF Shorts. Swing trade, GBPUSD is another shouting SHORT to me.

Here is the….CHART!

You can find my shameless, fatal market calls on Twitter and charts on Chart.ly.

It is Friday!

I managed to make some trades this week. CHFJPY, NZDUSD shorts are the winners of the week while I missed out some short term trades in AuDUSD, AUDJPY, NZDJPY. Having in the slightly ‘difficult’ situation recently, unpleasant day job, family issues, stress were building up faster than I imagined,this situation put me in some sorts of tests. I learned heaps. And fortunately, not in the hard way.

And most importantly, my overall trading survives. Having strategies in place for different time frames and market conditions, it helps to maintain profitablity consistently. My overall objective is to always maintain profitable week if possible. I asked myself ‘Why would I bother to continue trading when I am in such difficult condition?’ My simple answer: Why not? I took a day or two off to rest, however, I don’t see the need to stop working just because I am under stress. In addition, I know I am prepared to trade. All I need to do is to execute the plan. OK, let’s don’t go into the lame topic,’The imporatance of trading plan’ BS. The point is, as long as you know what you are doing, then don’t stop doing it.

I am sitting on cash now, and no trading on Friday. Spending time with my family, and looking forward to meeting some friends for a farewell dinner before they leave Australia.

As usual, if you are interested in listening to my nonsense and some fatal/shameless market calls, follow me on Twitter.

Or picture of AUDUSD before $60 billion budget deficit? 🙂

Well, it is a shouting SHORT….. Keep this chart as record. Not sure about the effect of budget 2009 to the currency. I am not trading the pair for now, but watching closely.

by Gav 3 Comments

I posted CHFJPY chart in chart.ly and twitter over the weekend. I saw a potential short setup. While CHFJPY is in the resistance zone, I am waiting to see if it stalls there before going short.

Though I have yet to see any immediate advantage of posting on chart.ly, it looks pretty interesting. I’ll try to post some charts there, but that’s only for experimental purposes. I prefer to to keep the ‘secrets’ here, on my own website. 😆

Anyway, here is the… CHART!

I am not going to post charts today. In summary, my Long positions of GBPJPY and USDJPY were slaughtered , Long AUDUSD made it all back with additional profit.Read my twit here.

If you live or visited Melbourne, Australia before, you should know about our most ‘Fabulous’ and ‘efficient’ public transport system. Let’s only talk about Tram here. With a 10 times 2 hour ticket, each trip will cost you $2.90, and without a valid ticket, if caught, a fine of around $120 will be charged.

I am not working for the transportation company, I do not care if they are making profit or loss. However, does it do you any good by not paying for the ticket? Let’s assume you travel from home to office everyday, and what is the Risk reward ratio and accuracy here?

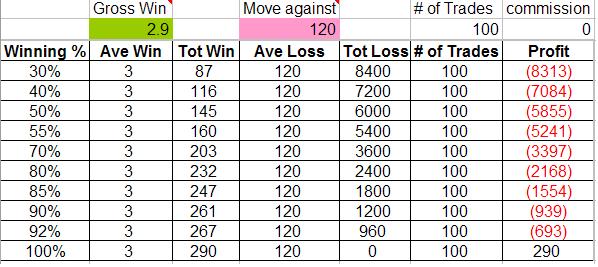

Talking in the trading language, each win will give you $2.9 profit. And each loss will cost you $120. How accurate does your system need to be in order to win the game? You need 100% winning rate. I have prepared the following table.

Why do you even bother to take this trade? I don’t get it. Maybe the feeling of winning (not paying and not being caught) covers the fact that risk reward ratio is not with us. Relate this to your trading, how are you doing? And, whether to pay for the tram ticket or not, it is up to you 🙂