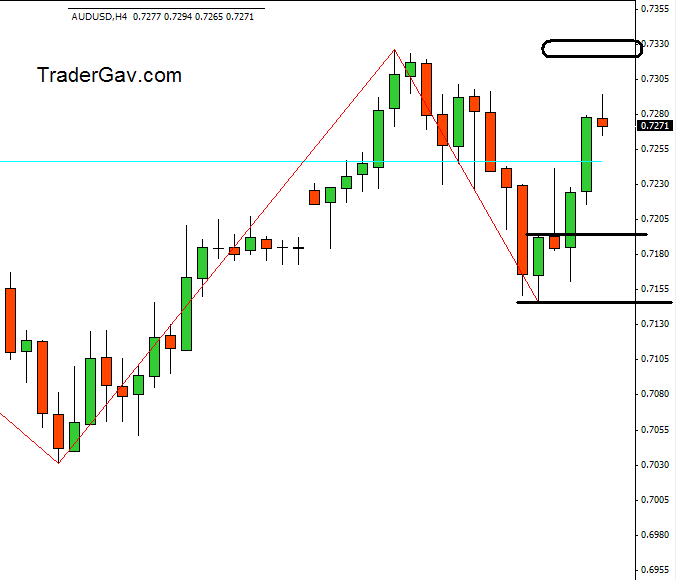

Or picture of AUDUSD before $60 billion budget deficit? 🙂 Well, it is a shouting SHORT….. Keep this chart as record. Not sure about the effect of budget 2009 to the currency. I am not trading the pair for now, but watching closely.

AUDUSD

Coffee thoughts of the day 29-April-2009

I am not going to post charts today. In summary, my Long positions of GBPJPY and USDJPY were slaughtered , Long AUDUSD made it all back with additional profit.Read my twit here. If you live or visited Melbourne, Australia before, you should know about our most ‘Fabulous’ and ‘efficient’ public transport system. Let’s only […]

AUDUSD trade 15-April-2009

This is to show you the chart of AUDUSD trade which I mentioned in Twitter yesterday. I would not disagree if you are considering taking some profit off the table. I see 0.73 is a good spot to unload some. Here is the….CHART!

Update & Happy Easter

A busy week for me. Enough stress and frustrations at my work place. I am trying to keep my head cool, and ignore the nonsense after leaving office. Since I am not in good mental and physical states, I did not make short term trade this week. Instead, I have been watching AUDUSD for 2 […]

Another look at AUDUSD

After briefly approached 0.71 vicinity, AUDUSD pulls back to 0.69 area. Is that a pull back, or we are again heading back to southern hemisphere? I have no idea. My take is , we have a chance to stay above 0.68 and looking at 0.72-ish level as next target. Play with care, that’s the plan. This […]

Is it time now? AUDUSD….

I am always looking at AUDUSD. Partly because I need to manage my USD exposure in my trading account. Anyway, I see AUDUSD trading in a tight range and potentially moving to 0.68-ish level. I am watching. On the other hand, I do not ignore the possibility of breaking down, and back to 0.63…AGAIN. Here […]