I am looking at Short position of Mini Dow at 11,112. A established downtrend is shown in 10-min chart.

Old blog archive

Paper Trade Series: Mini Dow 21-June-2006

It is a excited opening for U.S market. From 1 min chart of Mini Dow,there was a good setup for Long position. Mini Dow futures was trading above 10, 15, and 30 period moving averages and closed above CBL entry level. RSI supported the entry decision by making higher lows. Entry was at 11075 with […]

Paper Trade Series: Mini Dow

15-min Mini Dow Finally , i got my new charting service up and running. I have been watching Mini Dow for opportunity. I have decided to perform paper trading for few days in order to get use of this new chart service. First entry is when Mini Dow broke recent downtrend and RSI making is […]

Charting Headache Continues: No trade today

It is going to take sometime for my new chart service to be activated. Maybe it is time for me to take break after some winning trades for the past 2 weeks. I can't risk by doing day trading with delayed chart. I 'll be back when the chart is available to me again. Be […]

Charting headache: No trade today

I do not believe it. My broker just replaced their charting service which delays 2 bars. This has a big implication to my day trading strategy. I can't make a timely decision based on the delay chart. I have decided not to trade today in order to sort out the charting problem. This is a […]

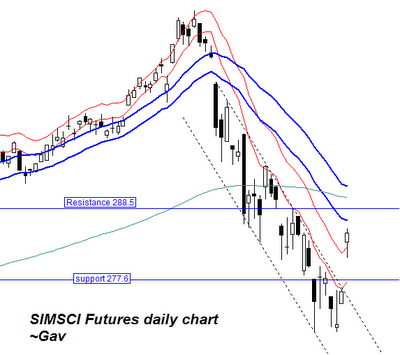

Chart Eye: SIMSCI Futures : ended 16-June-2006

This is daily chart of SIMSCI futures. It broke out from existing downtrend channel last Friday after a strong day. It is currently facing resistance soon. Directional index has started ticking up after reaching oversold level. And trend index shows a same picture as well. Sentiment is improving though it is still remain negative. It […]