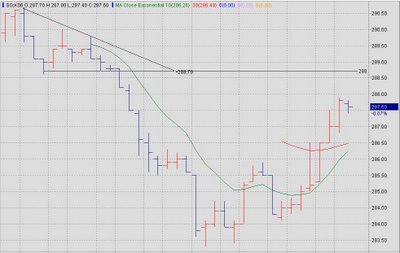

It was nice to have a descending triangle price setup. Short position was taken. Position was established at 288 and closed at 286.1 as trailing stop was triggered. Gain 1.9.

Old blog archive

About Short selling

There were few postings on Traderswin stocks trading blog targeting on shorting candidates over the past few days. From BeautyChina, HTL Intl to StatsChipac , Datacraft and DMX tech. With the negative market sentiment, these counters are currently moving our favour. I have quoted some rules for short selling from Leon Wilson, a outstanding Australian […]

News: Celebrity market guru arrested

This news caught my attention. Larry Williams was arrested for alleged tax evasion. Full details of the news can be found in the link below. Celebrity market guru arrested This is just for entertainment during this bearish day.

Pattern Trading : Short SIMSCI 25-May-2006

This is an intraday pattern trade. First, negative opening of Nikkei and HangSeng gave me a direction of the day. I would prefer trading on the Short side today. A descending triangle was formed which supports the negative sentiment. Here is a 12-min chart for the morning session.

Short : DMX Tech 25-May-2006

Dmx Tech looks weak. Trend conclusion is possible scene. And sellers’ force are strong. It is currently trading below 150-day moving average. I am interested in watching DMX for possible short sell opportunity. Immediate support : 0.82 First target is set at 0.74.

SIMSCI 24-May-2006 : No Trade

As expected, it was a choppy day for SIMSCI. No position was established as market seems to be directionless. This is 12-min chart. The view of choppy day was built when observing positive Nikkei and negative Hang Seng during morning session. These two leading indices in regional market are contradicting and it was likely to […]