Here are the articles in my weekend reading list Better to be lucky than good?: What makes a career is coming in most days and making steady, consistent amounts in the markets and taking the bonuses when they come along.. – by Lee Gibbs – Tags: traders development – http://www.futexlive.com/blog_post.php?id=33 Consistency Is Not A Game […]

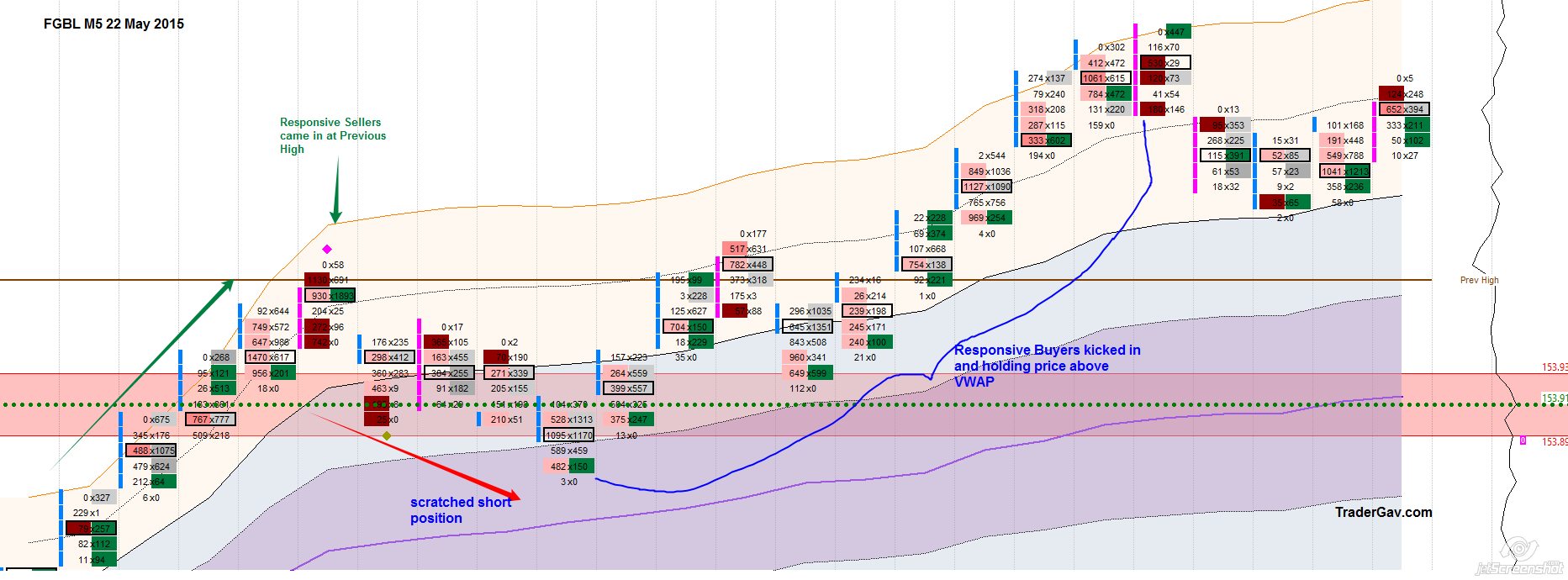

22 May 2015 FGBL Footprint chart responsive buyers & sellers

22 May 2015 FGBL Footprint chart

My Weekend reading list 23 May 2015

Here are the articles I have collected (yes, a long list of readings) I thought might be useful for personal/trader’s development.

My Weekend reading list: Saturday ,11 April 2015

Here are the articles/blog posts in my weekend reading list The One Secret to Becoming a Successful Trader: The one secret to becoming a successful trader is…….. ……a myth. Anyone who tells you otherwise is lying and is trying to fleece you out of your hard earned cash. There is no magic formula, no charting […]

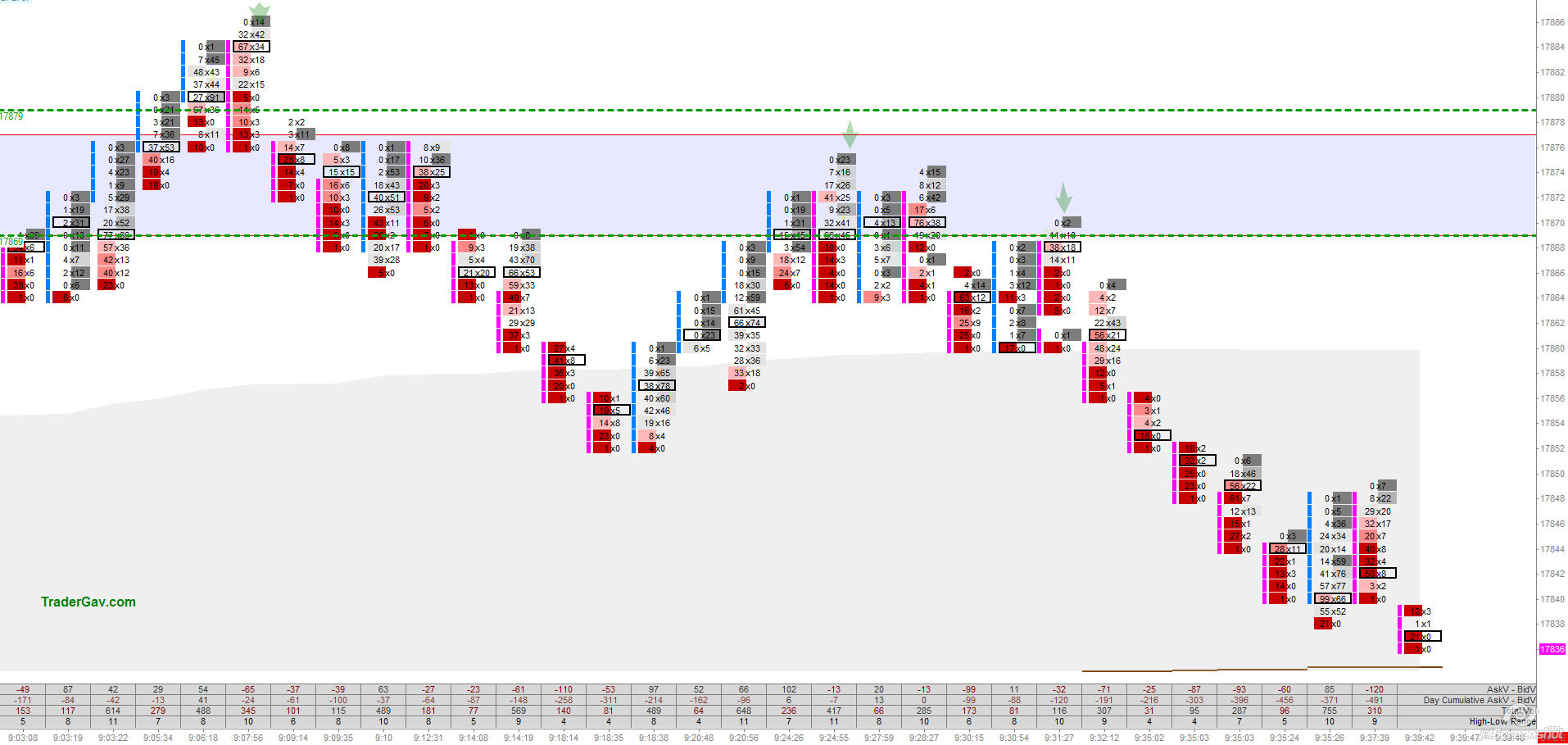

09 April 2015 YM Entry chart

YM 3 intraday swing entries during morning session.

My Weekend reading list: Saturday ,31 January 2015

Here are the articles in my weekend reading list